Trading strategies

Explore practical techniques to help you plan, analyse and improve your trades.

Our library of trading strategy articles is designed to help you strengthen your market approach. Discover how different strategies can be applied across asset classes, and how to adapt to changing market conditions.

Volatility doesn't discriminate. But it can punish the unprepared.

Stops getting hit on moves that reverse within minutes. Premiums on short-dated options climbing. And the yen no longer behaving as the reliable hedge it once was.

For traders across Asia, navigating this environment means asking harder questions about risk, timing, and the assumptions baked into strategies built for calmer markets.

1. How do I trade VIX CFDs during a geopolitical shock?

The CBOE Volatility Index (VIX) measures the market’s expectation of 30-day implied volatility on the S&P 500. It is often called the “fear gauge.” During geopolitical shocks such as the current Iran escalations, sanctions announcements, and surprise central bank actions, the VIX can spike sharply and quickly.

What makes VIX CFDs different in a shock

VIX itself is not directly tradeable. VIX CFDs are typically priced off VIX futures, which means they carry contango drag in normal conditions.

During a geopolitical shock, several things can happen at once

- Spot VIX may spike immediately while near-term futures lag, creating a disconnect.

- Spreads on VIX CFDs can widen significantly as liquidity thins.

- Margin requirements may change intraday as broker risk models adjust.

- VIX tends to mean-revert after spikes, so timing and duration are critical.

What this means for Asian-hours traders

Asian market hours mean many geopolitical events can break while local traders are active or just starting their session.

A shock that hits during Tokyo hours may already be priced into VIX futures before Sydney opens.

Some traders use VIX CFD positions as a short-term hedge against equity portfolios rather than a directional trade. Others trade the reversion (the move back toward historical averages once the initial spike fades). Both approaches carry distinct risks, and neither guarantees a specific outcome.

2. Why are my 0DTE options premiums so expensive right now?

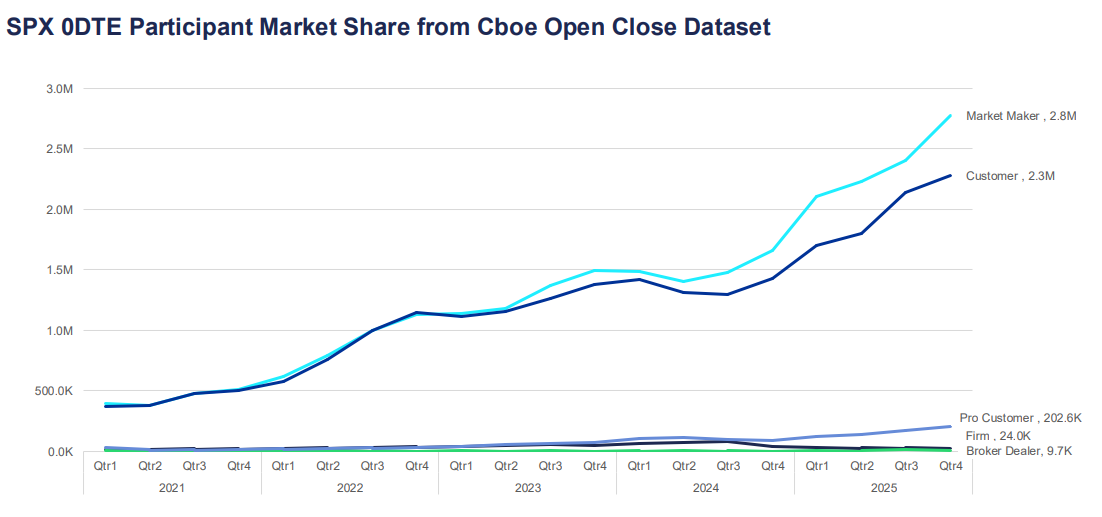

Zero days-to-expiry (0DTE) options expire on the same day they are traded. They have become one of the fastest-growing segments of the options market, now representing more than 57% of daily S&P 500 options volume according to Cboe global markets data.

For Asian-based participants accessing US options markets, elevated premiums during volatile periods can feel like mispricing, but usually reflects structural pricing factors.

Why premiums spike

Options pricing is driven by intrinsic value and time value. For 0DTE options, there is almost no time value left, which might suggest they should be cheap but the implied volatility component compensates for that.

When uncertainty increases, sellers may demand greater compensation for the risk of sharp intraday moves.

This can be reflected in

- Higher implied volatility inputs.

- Wider bid-ask spreads.

- Faster adjustments in delta and gamma hedging.

In higher-VIX environments, hedging flows can contribute to short-term feedback loops in the underlying index. This can amplify price swings, particularly around key levels.

What this means for Asian-hours traders

Many 0DTE options contracts see their most active pricing and hedging flows during US trading hours. Entering positions during the Asian session may mean facing stale pricing or wider spreads.

If you are seeing expensive premiums, it may reflect the market accurately pricing the risk of a large same-day move. Whether that premium is worth paying depends on your view of the likely intraday range and your risk tolerance, not on the absolute dollar figure alone.

3. How do I adjust my algorithmic trading bot for a high-VIX environment?

Many algorithmic trading systems are built on parameters calibrated during lower-volatility regimes. When VIX spikes, those parameters can become outdated quickly.

The regime mismatch problem

Most trading algorithms use historical data to set position sizes, stop distances, and entry thresholds. That data reflects the conditions during which the system was tested. If VIX moves from 15 to 35, the statistical assumptions underpinning those settings may no longer hold.

Common failure modes in high-VIX environments include

- Stops triggered repeatedly by noise before the intended directional move occurs.

- Position sizing based on fixed-dollar risk, which becomes relatively small compared to actual intraday ranges.

- Correlation assumptions between assets breaking down.

- Slippage on execution that erodes edge.

Approaches some algorithmic traders consider

Rather than running a single fixed set of parameters, some systems incorporate a volatility regime filter. This is a real-time check on VIX or ATR that triggers a switch to different settings when conditions shift.

Approach adjustments that some traders review in high-VIX environments

- Widen stop distances proportionally to ATR to reduce noise-driven exits.

- Reduce position size to maintain constant dollar risk relative to wider expected ranges.

- Add a VIX threshold above which the system pauses or moves to paper trading mode.

- Reduce the number of simultaneous positions, as correlations tend to rise during market stress.

No adjustment eliminates risk. Backtesting new parameters on historical high-VIX periods can provide some indication of likely performance, though past conditions are not a reliable guide to future outcomes.

4. Is the Japanese Yen (JPY) still a reliable safe-haven trade?

During periods of global risk aversion, capital has historically flowed into JPY as investors unwind carry trades and seek lower-volatility holdings. However, the reliability of this dynamic has become more conditional.

Why has the yen historically moved as a safe haven?

Japan’s historically low interest rates made JPY the funding currency of choice for carry trades and when risk-off sentiment hits, those trades unwind quickly, creating demand for yen.

Additionally, Japan’s large net foreign asset position means Japanese investors tend to repatriate capital during crises, further supporting JPY.

What has changed

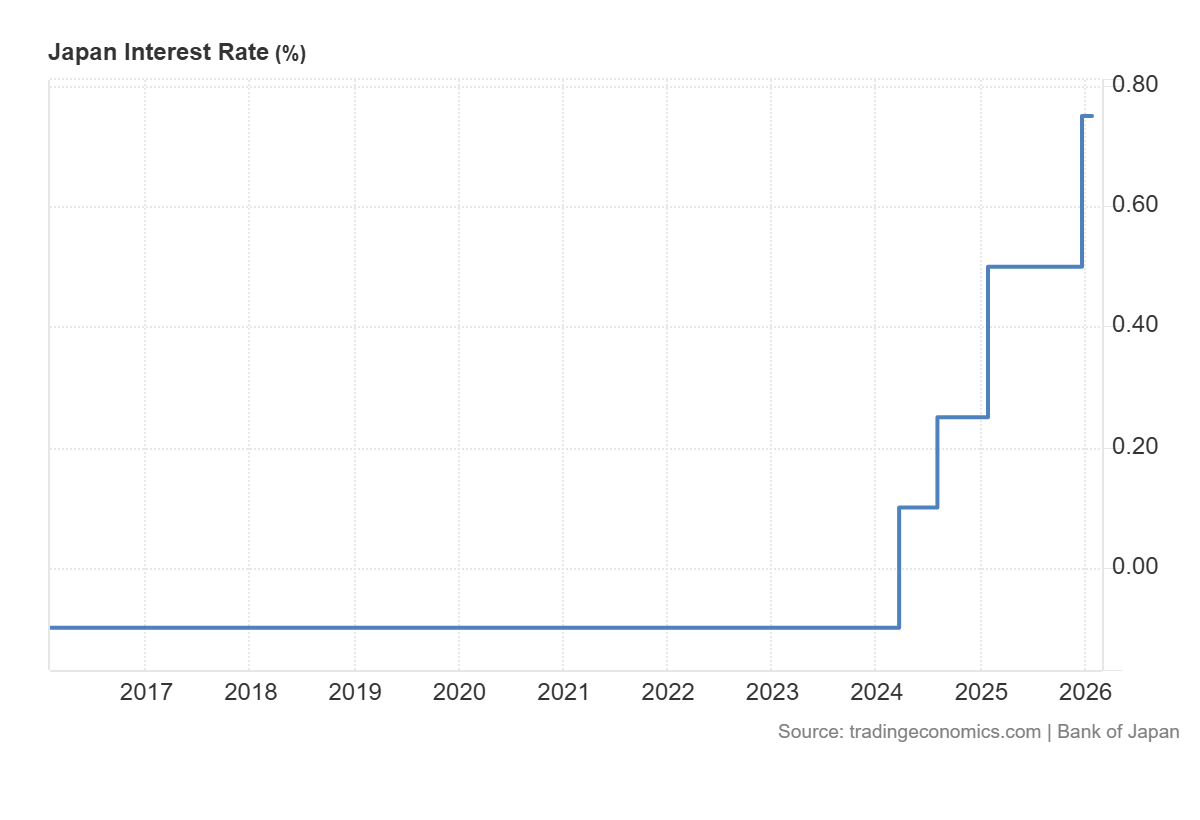

The Bank of Japan’s shift away from ultra-loose monetary policy in recent years has complicated the traditional safe-haven dynamic.

As Japanese interest rates rise:

- The scale of carry trade positioning may change.

- USD/JPY can become more sensitive to interest rate spreads.

- BoJ communication and domestic inflation data may influence JPY independently of global risk appetite.

The yen can still behave as a safe haven, particularly during sharp equity sell-offs. But it may respond more slowly or inconsistently compared to earlier cycles when the policy divergence between Japan and the rest of the world was more extreme.

What to watch

For traders monitoring JPY as a safe-haven signal, BoJ meeting dates, Japanese CPI releases, and real-time US-Japan rate spread data have become more relevant inputs than they were a few years ago.

5. How do I avoid ‘whipsawing’ on energy CFDs?

Whipsawing describes the experience of entering a trade in one direction, getting stopped out as the price reverses, then watching the price move back in the original direction.

Energy CFDs, particularly crude oil, are especially prone to this in volatile markets. And for traders in Asia, the combination of thin liquidity during local hours and sensitivity to geopolitical headlines can make this particularly challenging.

Why energy CFDs whipsaw

Crude oil is sensitive to a wide range of headline drivers: OPEC+ production decisions, US inventory data, geopolitical supply disruptions, and currency moves.

In high-volatility environments, the market can react strongly to each headline before reversing when the next one arrives.

- Price spikes on a headline, stops are triggered on short positions.

- Traders re-enter long, expecting continuation.

- A second headline or profit-taking reverses the move.

- Long stops are hit. The cycle repeats.

Approaches traders may consider to manage whipsaw risk

Some traders choose to change their risk controls in volatile conditions (for example, reviewing stop placement relative to volatility measures). However these may increase losses; execution and slippage risks can rise sharply in fast markets

Other approaches that some traders review:

- Avoid trading crude oil CFDs in the 30 minutes before and after major scheduled data releases.

- Use a longer timeframe chart to identify the prevailing trend before entering on a shorter timeframe, reducing the chance of trading against larger institutional flows.

- Scale into positions in stages rather than committing full size on initial entry.

- Monitor open interest and volume to distinguish between moves with genuine participation and low-liquidity fakeouts.

Whipsawing cannot be eliminated entirely in volatile energy markets. The goal of risk management in these conditions is not to predict which moves will hold, but to ensure that losses on false moves are smaller than gains when a genuine directional move follows.

Practical considerations for volatile Asian markets

Asian markets carry structural characteristics that interact with volatility differently from US or European markets:

- Thinner liquidity during local hours can exaggerate moves on thin volume, particularly in energy and FX CFDs.

- Events in China, including PMI releases, trade data, and PBOC policy signals, can move regional indices.

- BoJ policy decisions have become a more active driver of JPY and Nikkei volatility in recent years.

- Overnight gaps from US session moves are a persistent structural risk for traders unable to monitor positions around the clock.

- Margin requirements on leveraged products can change at short notice during high-VIX periods.

Frequently asked questions about volatility in Asian markets

What does a high VIX reading mean for Asian equity indices?

VIX measures expected volatility on the S&P 500, but elevated readings typically reflect global risk aversion that flows across markets. Asian indices such as the Nikkei 225, Hang Seng, and ASX 200 can often see increased volatility and negative correlation with sharp VIX spikes.

Can 0DTE options be traded during Asian hours?

Access depends on the platform and the specific instrument. US equity index 0DTE options are most actively priced during US trading hours. Asian traders may face wider spreads and less representative pricing outside those hours.

Are algorithmic trading strategies inherently riskier in high-volatility conditions?

Strategies calibrated during low-volatility periods may perform differently in high-VIX environments. Regular review of parameters against current market conditions is prudent for any systematic approach.

Has the JPY safe-haven trade changed permanently?

The Bank of Japan’s policy normalisation has introduced new dynamics, but JPY has continued to strengthen during some risk-off episodes. It may be more conditional on the nature of the shock and the BoJ’s concurrent posture.

What is the best way to set stops on energy CFDs in high-volatility conditions?

There is no universally best method. Many traders reference ATR to calibrate stop distances to prevailing conditions rather than using fixed levels. This does not guarantee exit at the desired price and does not eliminate whipsaw risk.

Welcome to 2025, a year that will be shaped by macro thematic events that were put in place at the end of 2024. Why we need to prioritise thematic analysis is that if we look at 2023 and 2024 indices and FX markets that were tied to the thematics of those two years outperformed peers and similar tools. Considering the S&P 500 returned a whopping 25 percent in 2024, starting the new year around the event that will shape the trading world is prudent.

So what will be the big thematics of 2025? Here are the five themes shaping the year ahead, each refined to align with evolving market dynamics: 1. The nationalisation of globalism Tricky title yes, but we are going to see a return to nationalistic policies from all walks of government.

This theme is likely to make a strong return in 2025 after pausing from about mid 2023. It will be driven by shifting global trade particularly the US and China and policy priorities of populist governments that are popping up all over the world. The push pull of nationalism versus globalism has rapidly swung back to nationalism since COVID.

Policymakers are consistently banging the drum that reducing reliance on globalised supply chains in favour of localised production and economic security. Just take a look at the policy ‘Future made in Australia’. This is a policy that is picking winners directly targeting manufacturing and a technology space that is already saturated with global supply.

The question we as traders and investors have to ask is will national policy supporting inefficient industry win out over global supply into the future? Theory would suggest not investment however follows the money and governments are piling money in. Again that's not to say it's right, it's just the flow.

With the return of a Trump administration to the White House not only is nationalistic policies going to be front and centre for investment tariffs and trade impacts will also be a major theme for 2025 and beyond. The playbook here is to review Trump 1.0 and look at the impacts on trade from 2017 to 2020. More on that below.

What is clear is the current populist shift to nationalism in global supply chains marks the biggest swing in trade systems since the 1960s. What we need to realise as investors is which multinationals and trading firms can adjust to the new reality and which will face the challenges that they are unable to survive. Identifying these changes will be key to investing going forward. 2.

China sandbagging One of the fastest developing thematics of 2025 is signs that Beijing it's starting to sandbag itself against future incoming tariffs from the West, specifically the US. Already we're seeing changes to liquidity ratios, policy and local government that haven't been in place since 2017 and 18. We're also starting to see policies around employment, aged care, and other social services that have not been enacted or tweaked in over half a decade.

Couple this with signs of increased infrastructure spending changes to manufacturing orders and a shift in direction to internal purchases. Shows Beijing really does mean business And is preparing to fight fire with fire. Most notably that ‘fire’ power is the tweaks that's happening to the renminbi.

The depreciation that has been allowed by the Peoples Bank of China (PBoC) shows very clearly that if tariffs are to be placed on Chinese exports the appearance at the import docks will be one of negligent, even better off positioning in price. It is a very, very savvy way of countering arbitrary cost increases from its biggest market, that of the US. How Washington responds to this change is likely to be just less dramatic.

Be prepared for a full blown currency trade war over the next four years as Beijing and Washington trade economic barbs. The winners and losers are already starting to present, case in point is the impact and slide in price of the Aussie dollar (AUD). Currently sitting at a 5 year low to start 2025 against the US dollar and having seen a 10 per cent decline against the JPY, and 8 per cent decline against the CHF, EUR and even a 5 per cent decline against the GBP.

The AUD’s China proxy thematic is well and truly kicking and the Aussie will be a key part of the China sandbagging thematic trade of 2025. 3. Meaningful living Do not underestimate the change in social structures around ‘meaningful living’. With aging populations across the developed world more and more societies are shifting to pursue healthier and more meaningful lives.

This is the rise of online and AI driven programming health treatments, new age drug consumption and a concentration on preventative medicine and health products. Meaningful living is moving the dial in policy, economies, and businesses. You only have to look at Apple's investment in its fitness app or the rise and rise of wearables.

Increase content on social media and the impact that AI is now having on medical and health related industries. On this point look to healthcare, particularly AI-driven advancements and obesity treatments to continue to be the stand out areas. Then there will be the changes to consumption behaviours, nutrition and affordable foods, ‘core value’ items over mass consumption as well as demand for more sustainable consumption practices.

The advantage of the meaningful living thematic is that it will likely be fairly isolated to the issues that will present from thematic 1 and 2. You will also be fairly insulated from changes of things like inflation, interest rates and politics. 4. Energy Thirst The thirst for energy supply coupled with decarbonisation is going to be a thematic not just of 2025 but over the next decade.

What will be different in 2025 is a short- and long-term supply change. Once again, nationalism will play a part here – the Trump administration has made it a cornerstone of its re-election pitch that oil will be front and centre in the US’s energy supply. However at the same time Elon Musk’s presence makes the outlook for battery storage and Electric Vehicles (EVs) also very interesting.

Longer term – energy will also face the ultimate question of 100 per cent renewables, a hybrid model that includes fossil fuels and/or a model that involves yellow cake. Uranium is facing an interesting period, the demand from China, France, the US and the like for nuclear energy is growing by the year. We are also now seeing nations that have never entertained nuclear having a debate on it as well (Australia is case in point).

Thus from a trade and investment point of view – we need to consider three points here: Supply - who are the suppliers that will benefit short term who benefits long term? And are there players that will benefit over the entire period? Demand – As stated in thematic 1,2 and 3 energy demand is only going to increase and if we include thematic 5 – not only will demand increase it could move almost exponentially.

Delivery – what form of apparatus is needed to deliver the energy nations need? That means everything from renewables to nuclear, micro units (household solar) to macro units (power plants). As well as energy storage, carbon capture and grid optimisation. 5.

AI the third digital revolution It’s been two years since ChatGPT’s debut – and in those 24 months more value has been created than in the 65 years from 1945 to 2010 and we are still early in AI’s widespread adoption. AI is being called the third digital revolution after the invention of the computer and the internet. The difference in 2025 from 23 and 24 is we are moving from “infrastructure” and “enablers” to applications.

Those programs that will drive efficiency and market leadership. Already the fight is on to be the “it” provider here as the likes of Alphabet, Meta, Microsoft and Amazon continue to redefine their individual offering. The trends here that will matter in 2025 are things like enterprise adoption of AI, which firms are adopting AI and its positive impacts?

Rapid increases in AI capabilities, surprising even the most optimistic expectations and how fast can it move? Expanded profit opportunities, reducing debates over AI’s return on investment. The faster we can understand the pace of these changes the more investors can capitalise on AI’s transformative potential.

In short, with these five thematics as our basis for 2025, it will be an exciting and transformative year.

For traders, the motivation to explore additional technical indicators often stems from a desire to enhance trading results and refine their existing system. With the abundance of information available about technical indicators, it can be tempting to incorporate new tools into your strategy. However, as the decision-maker in your trading journey, it is crucial to approach this process with a structured mindset.

The first step is to ask yourself a fundamental question: “Is it the right time to explore the use of another indicator?” This article outlines four critical questions you should consider before introducing new technical indicators into your trading system. 1) Am I Fully Actioning my Existing System? The primary motivation for adding a new indicator is often to improve the results of your current trading system. However, such improvements can only be measured if you have a well-defined system and are consistently trading it as designed.

A comprehensive system should at least include rules for entry, exit, and position sizing. Key Considerations: Are you faithfully following your current trading plan? Are you journaling your trades to track adherence and outcomes?

For many traders, the root issue lies in either an incomplete system or inconsistent execution. Honest self-assessment, backed by evidence from a trading journal, will help identify gaps in your current approach. Addressing these gaps should be your priority before adding another layer of complexity with a new indicator.

Action Steps: Review your trading journal to ensure you are consistently following your existing plan. Focus on refining your discipline and execution rather than prematurely seeking additional tools. 2) Is Adding Another Indicator the Most Impactful Change I Can Make Right Now to my trading? Improving your trading outcomes involves prioritizing actions that offer the highest potential for positive change.

While adding an indicator may seem appealing, there are other critical areas to address first: Trading Plan and Discipline: Ensure your existing plan is robust and that you are adhering to it consistently. Journaling: Regularly document your trades to provide a foundation for evaluating performance. Knowledge Development: Deepen your understanding of the indicators you already use.

Recognize what they reveal about market conditions and their limitations. Expanding your knowledge not only helps you maximize the effectiveness of your current tools but also enables you to make informed decisions about integrating new ones. In many cases, these priorities may outweigh the benefits of adding another indicator at this stage.

Action Steps: Evaluate whether enhancing your plan, discipline, or learning offers more immediate value than exploring new indicators. Commit time to mastering your existing tools before seeking additional complexity. 3) Do I Have Clarity on What any New Indicator Should Achieve? Before introducing a new indicator, you must clearly define its intended purpose.

Start by identifying whether your focus is on improving entries, exits, or another specific aspect of your trading system. Once you’ve pinpointed the objective, consider whether adjustments to your current indicators might achieve the same goal. Example: If you use a 10-period EMA as an exit signal but find it too sensitive to market noise, you could test a simple adjustment, such as switching to a 20-period EMA, before adding a new indicator.

Action Steps: Identify the specific gap in your system that a new indicator would address. Evaluate whether tweaking the parameters of your current tools could achieve the desired improvement. Test adjustments thoroughly before implementation. 4) Do I Have a Formal Testing Process in place for an evaluation of a New Indicator?

Introducing a new indicator requires a structured testing process to evaluate its impact on your trading outcomes. This process ensures that any changes to your system are based on evidence, not speculation. Testing Framework: Back-Test: Analyze past trades to determine how the new indicator would have influenced outcomes.

The goal is to justify the need for a forward test. Forward Test: Use a demo account to test the indicator in real-time market conditions. Maintain all other aspects of your trading plan to isolate the indicator’s impact.

Trading Plan Integration: If testing yields positive results, document how the indicator will be used within your trading plan. Be specific about its role and under what conditions it will be applied. Review Period: Set a timeline (e.g., three months) to assess the indicator’s performance and its contribution to your overall strategy.

Action Steps: Develop a clear and disciplined testing process. Specify the number of trades you consider sufficient for evaluating the indicator’s effectiveness. Regularly review and refine your approach based on test results.

Conclusion Adding new indicators to your trading system can undoubtedly enhance outcomes, but only when approached strategically. Before making changes, take the time to ask yourself these four critical questions: Am I fully utilizing my existing system? Is adding another indicator the most impactful change I can make right now?

Do I have clarity on what the new indicator should achieve? Do I have a formal testing process in place? By addressing these questions, you can ensure that any decision to incorporate a new indicator is well-informed and aligned with your broader trading goals.

Thoughtful preparation and disciplined execution will ultimately yield the best results for your trading journey.

The Parabolic SAR (Stop and Reverse) is a widely recognised technical indicator that has stood the test of time and is used by many trades to this day. First introduced by J. Welles Wilder in his 1978 book "New Concepts in Technical Trading Systems", the Parabolic SAR gained popularity as a trend-following tool due to its simplicity and visual appeal.

By plotting dots above or below the price, the indicator facilitates traders to identify potential reversal points in the market that can theoretically be used as the basis for long or short strategy entry points and, of course, for exit also. However, like any trading tool, it is worth emphasising that the Parabolic SAR works best when combined with other criteria and considerations and an understanding how it works is necessary prior to developing a trading strategy around this approach to trading reversals. This article explores how to effectively use it for entry and exit points, discusses its advantages and limitations, and introduces refined methods to improve its reliability.

What Is the Parabolic SAR? In simple terms, the Parabolic SAR is a price and time-based indicator designed to highlight potential trend reversals. Its dots appear: Below the price during an uptrend, indicating bullish conditions.

Above the price during a downtrend, indicating bearish conditions. As trends develop, the dots "accelerate" closer to the price, making the SAR more sensitive to price movements. This acceleration is driven by a so-called “ Acceleration Factor (AF)”, a parameter that increases as the trend continues.

Ultimately, and as a sign that a trend may be ending, the dots change from below to above and vice versa depending on trend direction. So, as with any strategy with trend following at its basis this indicator can be used in decision making for such strategies. Before we get into its actual use there are a few noteworthy benefits and limitations worth highlighting.

The chart example below (4-hourly gold CFD) shows the basic concept of SAR dot entry and exit for long and short trades respectively. Advantages of the Parabolic SAR The Parabolic SAR offers a few key benefits that can add to both its ease and method of use, these include: Visual Simplicity: Its dots provide an intuitive, easy-to-read representation of trend direction and potential reversals. Dynamic Trailing Stop: The SAR adapts to price movement, making it a useful tool for managing risk and locking in profits.

Trend Confirmation: It helps traders stay in trending markets by signalling when to hold positions or whether it may be worth considering exit. Versatility: Although originally designed for use on stock charts, calculation of the dots happens automatically irrespective of the chart you are applying it to, thus contributing to its popularity through adapting to any instrument (e.g. Forex, index or commodity CFDs) or timeframes.

Limitations of the Parabolic SAR Despite its advantages, the SAR has notable drawbacks: Choppy Market Signals: In ranging or sideways markets, the SAR often generates false signals, leading to unnecessary trades. Lagging Nature: While the SAR adapts over time, as with the majority of platform based indicators, it can lag during fast-moving trends, resulting in delayed exits. Lack of Context: The SAR does not consider market context, previous support and resistance levels, or external factors like news events.

Explanation of the Parabolic SAR Settings (PSAR) The two key default settings of Step (0.02) and Maximum Step (0.20) that you will see when you open the indicator on your trading platform, aim to strike a balance between sensitivity and stability. These settings are generally designed to work well in trending markets, and although we usually suggest that when first used, you use the default settings, you will discover in time there may be some benefit in adjustment for different trading styles or market conditions. As with all indicators used on your charts, you should not only understand what the indicator is telling you (and what it is not!), but also what settings indicate so that you may adjust to suit your particular trading style and objectives.

Understanding how these settings affect the indicator's responsiveness is key to optimising the potential use of this indicator. Step (Acceleration Factor): Default Value: 0.02 What It Does: The Step determines the rate at which the SAR dots accelerate toward the price as the trend progresses. Each time a new high (in an uptrend) or a new low (in a downtrend) is reached, the SAR calculation becomes more sensitive by increasing the Step value.

The Step starts at the initial value (e.g., 0.02) and increments by the same amount with every new extreme point in the trend. Impact: A smaller Step (e.g., 0.01) results in a slower acceleration, making the SAR less sensitive but more suitable for long-term trends. A larger Step (e.g., 0.03 or 0.05) increases sensitivity, making it more responsive but prone to false signals in choppy markets.

Maximum Step: Default Value: 0.20 What It Does: The Maximum Step is the cap for how far the Step value can increase during a trend. It ensures that the SAR does not become overly sensitive as the trend progresses, which would lead to premature reversals being signalled. Impact: A lower Maximum Step (e.g., 0.10) results in fewer reversals being signalled, making the SAR more stable in strong trends.

A higher Maximum Step (e.g., 0.30) increases sensitivity and may generate earlier exit signals but can also lead to more false positives. How These Settings Work Together The Step and Maximum Step settings control how quickly the SAR dots move closer to the price and how responsive the indicator is: At the start of a trend, the dots are further away from the price. As the trend strengthens, the Step increases, bringing the SAR dots closer to the price.

Once the Step reaches the Maximum Step, no further acceleration occurs, maintaining stability during extended trends. Examples of the Default Settings in Action Slow and Strong Trends With the default Step of 0.02 and Maximum Step of 0.20, the SAR is moderately sensitive: It allows the price some room to fluctuate without immediately signalling a reversal. This is ideal for trending markets where the price steadily moves in one direction.

Use a smaller Step (e.g., 0.01) and Maximum Step (e.g., 0.15) for smoother, less frequent signals that may suit swing or long-term traders. Short-Term, Volatile Markets If you increase the Step to 0.03 or 0.05, the SAR becomes more responsive (and so may suit scalpers or short-term traders): It adjusts faster to price changes, signalling reversals more quickly. However, this can lead to more false signals in sideways or choppy markets.

Use the Parabolic SAR for Entry Using the Parabolic SAR for entries is most effective when combined with other criteria to filter out false signals. Consider the following refined entry criteria: Dot Switching: Look for the SAR dot to switch from above the price to below (for a long entry) or from below to above (for a short entry). Candle Structure: For long entries, an entry candle close in the top 30% of its range, may suggest bullish momentum.

For short entries, an entry candle close in the bottom 30% of its range, may support bearish momentum may be developing. Sequence Length: Confirm that the previous SAR sequence lasted for at least 3 dots. This helps avoid signals caused by short-lived consolidations and retracements.

Volume Confirmation: Look for increasing volume during the breakout or reversal, which strengthens the likelihood of a genuine trend shift. Confluence with Additional Indicators: There may be some benefit in combining the SAR with complementary indicators such as the MACD. Look for MACD line crossovers to confirm the trend and increasing momentum as seen in the histogram bar length.

Proximity of previous key levels: Close proximity of previous resistance levels or swing highs above a potential long trade may be an indication that upside potential may be limited. Therefore, some caution in entry may be prudent, Obviously, the reverse is the case for short trades i.e. watch for close proximity of previous support or swing lows near short entry, Entry Criteria 2: Alternative approaches Although not commonly discussed, in an attempt to avoid the risk of a consolidating market with dots frequently switching above and below price there are a couple of additional approaches that may be worth consideration and testing. Using higher timeframe confirmation of trend: This could be using any presence of trend indicator e.g., a 4-hourly chart when trading an hourly timeframe, Using a breach of the price of the first dot of the previous sequence: This may suggest a move out of any potential sideways trend.

Let’s call this an “A dot” for this explanation. The chart example below (GBPJPY 30min) shows using the A-dot of previous SAR dot sequence a breach of which confirms move above potential sideways trend risk and potentially a higher probability trade opportunity (although lesser return) than standard approach. Exit Criteria: Using the SAR for Reversals The Parabolic SAR excels at signalling trend exits, especially when a trend reversal is imminent.

Here’s how to use it effectively for exits: Dot Switching: A dot switching to the opposite side of the price can serve as an early warning of a potential reversal. Additional Reversal Signs: These can be added to the basic dot switching described above. Candle Structure: Look for candle reversal patterns, such as engulfing candles, Doji formations, or pin bars.

Volume Drop: Declining volume near the end of a trend may signal that momentum is fading. Additionally, when the dots reverse there may be an increase in volume as the reversal is confirmed, Trailing Stop: Use the current SAR dot level as a trailing stop to lock in profits as the trend progresses. Summary The Parabolic SAR is a versatile and visually intuitive tool that can help traders identify trends, manage trades, and spot reversals.

However, it is most effective when combined with other criteria, such as candle structure, volume, and momentum indicators. If one invests time in measurement and testing then alternative settings can be explored that may better suit your desired trading objectives and strategy choice. Using alternative approaches as discussed above, may be also worth testing consideration, as well of course, its inclusion within a defined exit strategy.

As with any indicator, while the SAR alone is insufficient for making trading decisions, it has potential as part of a broader trading strategy. By understanding its strengths, limitations, and applications, traders can better harness the power of this classic indicator to navigate the complexities of the markets and instruments and timeframes of choice. We trust that this article not only adds to your knowledge and trading potential but would be delighted to welcome you to our live events where strategies such as this are discussed and demonstrated live in detail.

Trading is a skill that requires continuous development, self-assessment, and refinement. For traders aiming to achieve consistent profitability and long-term success, following a structured process can make the difference between stagnation and mastery. In this article, we’ll explore a systemized five-step process for trading development, designed to help you identify gaps, take ownership of your growth, and implement effective strategies.

Additionally we will discuss not only why traders avoid this approach (including a checklist) and what YOU can expect if you follow through on some of the methods used Why This Approach Is Often Overlooked While the systemized approach to trading development is logical and proven, it remains unpopular among many traders. This is largely because it requires introspection, effort, and patience—qualities that often take a backseat to the allure of quick fixes. Many traders fall into the trap of chasing the "next big strategy" or the "magic bullet" that promises instant success without the need for sustained effort.

Reasons Why Traders Avoid This Approach: - Impatience: The desire for immediate results often overshadows the commitment required for gradual improvement. - Overconfidence: Many traders believe they can succeed without addressing fundamental gaps, relying solely on luck or intuition. - Fear of Failure: Self-assessment can be uncomfortable and may reveal mistakes or shortcomings that traders prefer to ignore. - Lack of Awareness: Some traders simply don’t recognise the value of a structured development process or don’t know how to start. - Shiny Object Syndrome: The constant search for new strategies and tools distracts from the need to refine existing skills and processes. - Time Constraints: Trading development requires time and effort, which may seem daunting when balancing other commitments. Checklist: Are You Avoiding This Process? - [ ] Do you often jump to new strategies without fully mastering your current one? - [ ] Do you avoid reviewing your past trades and learning from mistakes? - [ ] Are you more focused on finding a winning indicator or strategy than improving your discipline and execution? - [ ] Do you feel uncomfortable facing your trading weaknesses? - [ ] Have you neglected setting clear goals and benchmarks for your trading? - [ ] Do you feel you lack the time to dedicate to structured development? If you checked any of the above, it’s worth reconsidering your approach.

A systematic process may seem less exciting, but it’s the cornerstone of long-term success. Your FIVE steps to trading development We have identified FIVE key areas of work to help you take your trading to the next level. Within each we have identified actions and suggested potential resources to help in your development journey.

Step 1: Benchmarking Gap Analysis Objective: Evaluate where you currently stand versus where you need to be in three key domains: technical skills, risk management, and psychological discipline. Steps: Assess Your Current Performance: Analyse your trade history, win/loss ratio, average return per trade, and consistency over time. Identify patterns in your trading (e.g., frequent stop-outs, giving too much back to the market on profitable trades, over-leveraging).

Define Your Ideal State: Identify those situations where you shouldn’t trade eg, when unwell, or routines you can put in place that will help you focus as soon as you look at your first chart of the day eg, realign with your trading plan. Specify what consistent profitability looks like for you. This might include metrics such as a 3:1 reward-to-risk ratio, an 80% adherence to your trading plan, or minimising emotional trades.

Conduct a Comparative Analysis: Pinpoint gaps in your knowledge, execution, or mindset. Ask yourself tough questions: Are you trading with discipline? Are your strategies well-tested?

Do you have a proper risk management plan? How to Achieve It: Use tools like trade journaling software, analytics platforms, or even manual spreadsheets to document and evaluate performance. Consider seeking out mentorship or coaching to gain an external perspective on areas for improvement.

Be honest with yourself. Acknowledging and owning areas of weaknesses is the first step toward progress. Step 2: Identification and Prioritization of the Gap Objective: Isolate the most critical gaps and prioritize them based on their impact on your results.

Actions: Categorize Your Gaps: Knowledge Gaps: Lack of understanding of market conditions, indicators, or trading strategies. Execution Gaps: Poor timing, impulsive decisions, or failing to follow your plan. Psychological Gaps: Fear of loss, overconfidence, or inability to manage stress.

Rank Gaps by Priority: Focus on the gaps that directly affect profitability or pose the highest risk to your account. For example, improper risk management may take precedence over optimizing your charting skills. How to Achieve It: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) specific to your trading.

Use performance metrics to quantify the severity of each gap (e.g., how many trades are lost due to poor discipline?). Limit your focus to the top 2-3 gaps to avoid overwhelming yourself. Step 3: Ownership and Plan Clarity Objective: Develop a clear, actionable plan and commit to executing it with accountability.

Action: Create Specific Goals: Example: “Improve adherence to my trading plan from 80% to 90% over the next month.” Break Down the Plan: Define daily, weekly, and monthly tasks. For instance: Daily: Review and refine your watchlist. Weekly: Analyze trade outcomes and adjust strategies.

Monthly: Evaluate progress against set benchmarks. Identify Required Resources: Educational materials (books, courses, webinars). Tools (backtesting software, risk calculators, journaling platforms).

Support systems (accountability groups, mentors, or trading communities). How to Achieve It: Use SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) to structure your plan. Establish accountability through regular check-ins with a trading partner or coach.

Create visual reminders (e.g., a whiteboard or app) to keep your plan front and centre. Step 4: Learning and Development in Real-Time Objective: Apply your learning to live or simulated markets to reinforce skills and refine strategies – then take LIVE action. Actions: Using a Demo Account for new approaches: Practice executing trades under realistic market conditions without risking real capital.

Setting up a “ghost account” alongside your LIVE account which can be used to test new strategies or see the impact of scaling before you do it in practice (so you get psychologically ready for those bigger profit and loss numbers) Have set criteria for when you will transition to live trading to reduce the chance of procrastination for taking your next step. Use a Trade Journal: Record every trade with details such as entry/exit points, rationale, outcome, and emotions. Analyse trends over time to uncover recurring mistakes or successful behaviours.

Embrace Feedback: Treat mistakes as learning opportunities. Ask, “What went wrong, and how can I fix it?” Review your trades weekly to identify progress and areas requiring further improvement. How to Achieve It: Simulate market conditions closely aligned with your trading style (e.g., day trading or swing trading).

Join forums or groups where traders share insights and feedback. Commit to a growth mindset: mistakes are inevitable but invaluable for learning. Step 5: Testing, Implementation, and Refinement Objective: Measure your progress, refine your strategies, and ensure a continuous cycle of improvement.

Steps: Test Against Key Metrics: Evaluate progress using your ‘results barometer’ (e.g., profitability, win rate, risk management adherence). Close the measurement circle: Make data-driven decisions to tweak your strategies or execution plans. For instance, if a strategy has a low win rate, analyse whether the issue lies in the strategy itself or its implementation.

Create a Feedback Loop: Revisit Steps 1-4 periodically to ensure continuous alignment with your goals. How to Achieve It: Set milestones (e.g., quarterly reviews of your trading results). Use A/B testing for strategies to compare performance under different conditions.

Celebrate small wins to maintain motivation. So If I Do These Five Stages, What Can I Expect in My Trading Performance? By committing to these five stages, you can logically expect a transformational shift in your trading.

Systematic development not only addresses gaps in your skills but also enhances your confidence and decision-making abilities. Here are the key benefits and reasons why this is the primary driver for action: 1. Improved Consistency: - Following a structured approach reduces impulsive and emotional trading decisions, helping you stick to your plan. - With refined strategies and clear benchmarks, your results will become more predictable over time. 2.

Enhanced Risk Management: - Identifying gaps in your approach allows you to minimise unnecessary risks and protect your capital more effectively. - A systematic process ensures that every trade is backed by sound risk-reward calculations. 3. Data-Driven Decision Making: - Regular review and analysis of your trades ensure that you’re making informed decisions based on evidence rather than guesswork. Commit the principle of “evidence based trading” to everything you do from here, 4.

Increased Confidence: - Knowing that you have addressed weaknesses and built a solid foundation instills greater confidence in your trades. - This confidence helps you remain calm and disciplined, even in volatile markets. 5. Continuous Growth: - The feedback loop ensures that you’re always learning and adapting to changing market conditions. - This adaptability is crucial for staying competitive in the long term. Ultimately, it is an unavoidable fact that the primary driver for taking action lies in the fact that trading success is not about finding shortcuts but about building sustainable habits and systems.

By embracing this process, you’ll not only give yourself a chance to improve your results but also develop the resilience and mindset required to thrive as a trader. Summary Trading is not a one-time skill but a lifelong journey of learning and adaptation. Through following this five-step systemized process, you can take greater control of your development, systematically address your weaknesses, and build on your strengths.

Success in trading doesn’t come from luck but from deliberate effort, discipline, and continuous refinement. Take the first step today, and remember: the best traders are always students of the market. And finally, we are here to help.

Our regular education sessions and videos are there to guide you, offering detailed explanation and clarity about many of the things covered in this article.

The "Santa Claus Rally" is a well-documented seasonal phenomenon in financial markets where stock prices often rise during a specific period at the end of the year. While widely discussed, it is frequently misunderstood or oversimplified. This article provides a detailed examination of the Santa Claus Rally, including what it is, why it happens, common misconceptions, its historical trends, and a close look at the factors influencing the markets in 2024.

What Is the Santa Claus Rally? The Santa Claus Rally refers to a pattern of stock market gains observed during the last five trading days of December and the first two trading days of January. This seven-day window, now an established market belief, was first identified by Yale Hirsch, who documented the Santa Claus Rally phenomenon in the 1972 edition of the Stock Trader’s Almanac.

It has since become one of the most recognized seasonal patterns in financial markets, has historically delivered positive returns across major indices, including the S&P 500 and Dow Jones Industrial Average. The phenomenon stands out because of its precise timing and consistent performance, making it distinct from broader year-end trends. Key Characteristics: Defined Timing: The rally occurs between December 26 and January 2, excluding earlier December market activity.

There is a common misconception that it may occur earlier we will discuss this later, Short-Term Nature: It is a brief but significant period, often viewed as a sentiment gauge for markets not only during but subsequent to this defined period. Predictive Potential: A strong or weak rally can sometimes hint at market behaviour in the early months of the new year. Why Does the Santa Claus Rally Happen?

The rally is driven by a combination of market psychology and market dynamics. While no single factor is definitive, the interplay of several influences creates favourable conditions for this pattern occurring. With these factors we will not only define each in turn but suggest the potential impact on such a rally.

Tax-Loss Harvesting Winds Down Definition: Tax-loss harvesting is when investors sell underperforming assets to offset capital gains, reducing their taxable income. Impact: This selling pressure, which weighs on markets earlier in December, subsides by the end of the month. With the selling completed, buying often resumes, pushing prices higher.

Holiday Cheer and Optimism The festive season fosters consumer and investor optimism. Strong holiday spending boosts confidence in consumer-driven sectors, and this optimism often spills over into the broader market. Investors may feel more inclined to take risks, leading to upward momentum in stock prices.

Institutional Repositioning Definition: Fund managers adjust portfolios at year-end to present favourable performance in annual reports. Impact: This often involves buying top-performing stocks, which adds upward pressure to the markets during the rally period. Low Trading Volumes Many institutional and retail investors take time off during the holidays, leading to lighter trading volumes.

In this environment, even modest buying activity can significantly impact prices. New Year Positioning As the year ends, investors reassess their portfolios, positioning for anticipated trends in the coming year. This activity often results in fresh buying, particularly in growth sectors.

Historical Performance relating to the Santa Claus Rally The Santa Claus Rally has proven to be a reliable phenomenon, delivering positive returns in most years. On average, the S&P 500 gains between 1% and 1.5% during this period. Historical Trends: The rally has produced gains in approximately 75% of years since it was first documented.

Its absence has occasionally been a precursor to weak market performance in January or even the full year. Key Examples: In 2008, amidst the global financial crisis, the Santa Claus Rally still materialized, providing a brief positive momentum during a challenging year. In 2015, the rally failed to occur, and markets experienced heightened volatility in January, highlighting its potential predictive significance.

Common Misconceptions about Santa Claus Rallies Despite its prominence, the Santa Claus Rally is often misunderstood. Some of the most common misconceptions include: Timing Confusion? Many believe the rally spans the entire month of December or starts before Christmas.

In reality, it is strictly confined to December 26–January 2. Any other December market move will be due to other market forces, Assumption of Guaranteed Gains? While historically frequent, the rally is not guaranteed.

External shocks or weak economic data can disrupt the pattern. Driven Solely by Retail Investors? A commonly held myth suggests that holiday bonuses or retail investor activity drives any such the rally.

In fact, as referenced above, institutional actions like window dressing and repositioning play a larger role. Overlap with Other Effects? Seasonal trends like the December Effect (general market strength in December) and the January Effect (small-cap outperformance in January) are distinct phenomena often conflated with the Santa Claus Rally.

Do we see a Santa Claus Rally Across World Markets? The Santa Claus Rally is most studied and reported for U.S. markets. While similar patterns may occur globally, their timing and drivers vary, but there is some evidence that may be of interest to those investing outside the US. 1.

European Markets United Kingdom (FTSE 100): The FTSE 100 has shown a tendency to perform well during the last week of December and the first week of January, much like the U.S. markets. A 2017 study by Schroders found that the FTSE 100 recorded positive returns in December approximately 78% of the time since 1986, with an average return of 2.4%. Germany (DAX): The DAX also tends to see year-end strength, reflecting broader European investor sentiment and repositioning similar to the U.S.

German equities benefit from strong consumer activity during the holiday season and institutional adjustments at year-end. 2. Asia-Pacific Markets Japan (Nikkei 225): The Nikkei 225 often experiences a "New Year Rally," which includes strong performance in the last few trading days of December and the first week of January. This trend is partially driven by institutional investors repositioning their portfolios for the new fiscal year (starting in April) and holiday optimism.

China (Shanghai Composite): While the Santa Claus Rally is less pronounced in Chinese markets, some evidence suggests a year-end rally occurs due to investor repositioning before the Lunar New Year (which falls between January and February). Australia (ASX 200): The Australian market often mirrors the Santa Claus Rally, with December being one of the best-performing months historically. Tax-related incentives also play a role, as Australia's fiscal year ends in June, leading to a broader seasonal trend than in the U.S.

Key Metrics to Watch Several indicators can help identify whether a Santa Claus Rally is likely or already underway, I have identified FIVE that may be particularly noteworthy: Market Sentiment Indicators Tools like the AAII Investor Sentiment Survey and the VIX (Volatility Index) reveal investor mood. Declining fear levels, as measured by the VIX, often support rally conditions. Sector Performance Growth-oriented sectors such as technology and consumer discretionary tend to lead during this period, reflecting holiday-driven optimism.

Trading Volume Trends Low volumes are typical during the holidays. However, any surge in buying activity can amplify upward price movements. Macroeconomic Data Economic indicators such as inflation figures or employment data can heavily influence sentiment.

Positive surprises may bolster the rally, while negative shocks could dampen it. Market Breadth A strong rally typically sees broad participation, with a high percentage of advancing stocks. Narrow gains driven by a few large caps indicate weaker underlying momentum.

What About This Year? As we approach the Santa Claus Rally period for 2024, several factors suggest potential market behaviour: Federal Reserve Actions The Fed has been gradually lowering interest rates, with the target range now at 4.5%–4.75%. While this policy supports market liquidity, concerns about persistent core inflation (hovering around 2.7%–2.8%) may lead to cautious policymaking in December.

Future rate cuts remain contingent on positive economic data. Market Performance The S&P 500 has seen year-to-date gains exceeding 27%, recently achieving record highs. This reflects robust investor confidence, with technology and consumer discretionary sectors leading the charge.

Strong earnings reports, such as Lululemon's 15.9% surge, underscore the strength of consumer-driven stocks. Economic Indicators Employment remains resilient, with November adding 227,000 jobs, though the unemployment rate has ticked up to 4.2%. This stabilization signals a soft landing for the economy.

Holiday retail sales projections are strong, if there are additional indications that his may be widespread, it may feed into positive reporting of Q4 earning due in January, this may continue the buoyancy of current market sentiment over the festive period, Geopolitical Factors Trade tensions, including potential new tariffs, introduce uncertainty. These policies could lead to inflationary pressures, dampening consumer spending. Any escalation in existing global conflicts, notably the Middle East situation may also obviously impact quickly and significantly on sentiment.

Investor Sentiment Despite high valuations, optimism remains buoyant, supported by historical patterns favouring December as a strong month for equities. However, caution is warranted given current market highs and the potential for market participants deciding valuations are high enough for right now. Summary The Santa Claus Rally remains a fascinating and historically consistent market phenomenon, driven by a mix of seasonal optimism, institutional actions, and economic conditions.

To stay on top of what is happening during this interesting period in markets may offer opportunity as well as inform risk management, For 2024, the stage appears set for a potential rally, with favourable monetary policy, strong market performance, and resilient economic indicators providing support. However, investors should monitor inflation trends, geopolitical developments, and market sentiment closely as the year draws to a close. Although primarily described in relation to US markets, there is evidence of similar phenomenon in other world markets which we have briefly referenced also.

Understanding the drivers and metrics of the Santa Claus Rally can help investors navigate this unique market period with confidence and insight.

Top 5 Benefits of a MT4 Demo Trading Account A MT4 Demo trading account is a virtual trading account that allows you to make virtual trades with play money. Demo trading accounts replicate Live trading accounts, but it removes the risk of losing your own trading capital until you are comfortable trading with real money. Most Forex brokers now offer a trial period of their Metatrader 4 demo account to those who want to familiarise themselves with a trading platform.

A Demo trading account is an ideal way to learn about a platform and how to place and manage trades. In a way, a Demo trading account is your ‘L’ plate when you’re just starting or learning to trade. At GO Markets, we provide the MetaTrader 4 (MT4) platform for a trial period of 30 days.

In this article, we will outline the major benefits of using a Demo trading account before going “Live”. These benefits include: 01. A Demo Trading Account is Free There is no cost to download and access a Demo trading account from your broker.

The only thing you need to provide is your name and email address and other relevant contact details. This is to make sure that you can also get support from your FX broker or provider in case you have any question about the Demo trading account or the platform. 02. Theory Into Practice If you’re new to FX trading, there is a lot to learn, especially about the mechanics of how an FX trade works.

For example, you need to know the different lot sizes, what is leverage and how you can use it for your trading, margin requirements, order types, and stop losses. Using a Demo trading account is the best way to put what you have learnt into practice. This will help you gauge your level of understanding before you commit real money.

Gaining any level of confidence in FX trading, no matter how small, always begins on a Demo trading account. 03. Familiarise Yourself With The Trading Platform If you’re a new trader, one of the most important things to do is to familiarise yourself with a trading platform. This is because a trading platform is your vital tool to execute your trades.

The more familiar you are to your chosen trading platform, the better and more efficient you could be with your trading. You also have to consider that different Forex brokers offer different trading platforms. So, it is important that you choose a trading platform that suits your trading style.

Alternatively, if you’re an existing trader and you’re moving from one broker to another, you may be required to use a different trading platform to one that you are used to. Once again you will need to familiarise yourself with the new platform. This process may take time, and a Demo trading account is the best way to get used to a platform without making costly mistakes. 04.

Testing a Trading Strategy There is a saying that goes, “Plan the trade, and trade the plan.” Planning your trades and sticking to your trading plans are vital if you are set on becoming a successful trader. However, it could be easier said than done. Planning your trades and executing your plans accordingly takes time and discipline.

And this is where a Demo trading account could be helpful as you need time to develop and adjust your trading plan and strategy. So whether you are trading manually or using an Expert Adviser, it is best to test your trading strategy on a Demo trading account. A Demo trading account allows you to test and refine your trading strategies without committing real money until you are happy with the results. 05.

Testing Trading Tools Most brokers now provide additional trading tools as a value add to their trading platform. For example, GO Markets provides the MT4 Genesis, which is a comprehensive suite of trading tools. Before using any additional trading tools, it’s highly recommended to test them out on a Demo trading account.

This will help you become more familiar with the tools and determine which ones are the most suitable and helpful for your trading needs. Considering all the benefits we’ve discussed, one thing to remember is that a Demo trading account does not fully prepare you for when you decide to trade for real. Despite all the benefits of Demo trading, it’s also important to note, that there are some drawbacks. » Different Trading Psychology – No matter how long you practice on a Demo trading account, there is no substitute for Live trading.

The main reason is the different psychology when using a Demo trading account compared to a Live trading account. Your mind acts differently once you are no longer practicing with “play” or “virtual” money, and you start trading with your hard earned cash. Where you may have traded larger lot sizes on a Demo trading account without too much concern, it may be harder to pull the trigger on a Live trading account.

Where a losing trade did not matter so much on a Demo trading account, it may be harder to accept a similar loss on a Live account. You may have been confident of your trading strategy on the Demo trading account, but now you’re about to go Live, you’re not so sure. » Risk Management – When downloading a Demo trading platform, beginners can choose how much virtual money they can play with. If the Demo trading goes well, this could easily lead to a false psychological expectation that placing large trades and making large profits is easy.

This leads to poor risk management practices that can carry over to Live trading. This usually leads to a poor trading performance. Demo trading is an important part of becoming a successful trader.

To get the most out your Demo trading I suggest the following: (1) Hone your skills and refine your trading strategy, and most importantly, learn from your mistakes. (2) If you intend to eventually start trading a Live account with a minimum balance of $500, open a Demo trading account with $500. Choose a starting balance on your Demo trading account similar to an amount that you would start on a Live trading account. (3) Treat Demo trading as if it’s the real deal. Try to feel all the emotions of trading – how it feels to have both winning and losing trades. (4) Stick with Demo trading until you are confident enough to trade Live.

At GO markets we offer a 30-day trial of our MT4 platform to both potential. Please click here to start your trial period today. Clients who open and fund a Live trading account with a minimum of $200, are able to get access to a “non-expiring” Demo account.

Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks.

Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies. See our MT4 tutorial videos here. Rom Revita | Sales Manager Rom is the Sales Manager at Go Markets Pty Ltd and manages the day-to-day running of the Sales, Support and Marketing teams.

He has been with the company since 2013 and is also one of our two appointed Responsible Managers, helping to ensure that the company follows all AFSL regulatory requirements. Rom has extensive financial markets experience and originally comes from an equities & derivatives trading background. He has served on the Trading & Sales Desk with several large broking houses, and now specialises in Margin FX and CFDs.

Connect with Rom: [email protected]