- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

CFD trading

Trade CFDs on forex, commodities, indices, and more.

Open accountTo open a CFD trading account as a Company, Trust, or SMSF, click here.

Share trading

Invest in shares and ETFs on the Australian share market.

Open accountOpen a Personal or Company/Trust/SMSF share trading account.

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- QANTAS confirms its plan for Project Sunrise

News & analysisThe major Australian airline announced its commitment to direct flights from Sydney and Melbourne to mainland Europe and the East Coast of America by 2026. The commitment was announced on the back of encouraging quarterly figures due to a strong recovery in the travel sector and the easing of many Covid restrictions.

Trading results

QANTAS announced its trading results for the quarter with the highlights being a strong reduction in debt from $5.5 billion to $4.5 billion from December 2021 to the end of April 2022. This is compared to a peak of over $6.4 billion of debt during the height of the border closures. The company is still expected to release significant underlying EBIT losses for the FY22 but insists it is on track for 2H22 underlying EBITDA of between $450 million and $550 million. Looking forward, QANTAS believes that by the fourth quarter of FY22 domestic capacity will be at 105% of pre covid levels and international capacity will be at 70% by the first quarter of FY23.

CEO Allan Joyce stated, “The recovery in business traffic has been faster than expected. Once mask mandates were removed and people went back to the office, there was a clear uptick in demand. We’re now at around 85% of pre-covid levels for domestic corporate travel and more than 100% for small businesses.”

Increasing Fuel Prices

With extremely high fuel prices, because of inflationary pressure and geopolitical crises, there was the potential for a costly blowout for QANTAS. However, the company was able to hedge its positions to protect itself from the ongoing volatility. The company outlined that 90% of its fuel for the second half of FY22 is hedged at levels below the current prices. Additionally, they will continue to adjust fare and fuel prices to meet market demands and volatility.

Project Sunrise and Commitment towards Airbus

The announcement of project sunrise and QANTAS’s firm order for 18 A321LRs, and 12 A350-1000s are a potential game-changer for the airline. The A350 -1000 will form the backbone of the strategy. By 2026, QANTAS is planning on being the first airline to connect the East Coast of Australia with cities such as Chicago, NYC, London, and Paris. This shift presents a chance for QANTAS to push itself forward and differentiate itself from the rest of the market.

Shift from Boeing

Qantas has long been a loyal customer of Boeing, however, as the airline moved into the 21st century this loyalty was beginning to wane as QANTAS began acquiring the Airbus A380 and the A330 over the Boeing 777 as part of its fleet. Whilst the company was and continues to operate the Boeing 737 as its major domestic workhorse, the shift towards Airbus for its long-haul flights signals a move away from the American manufacturer.

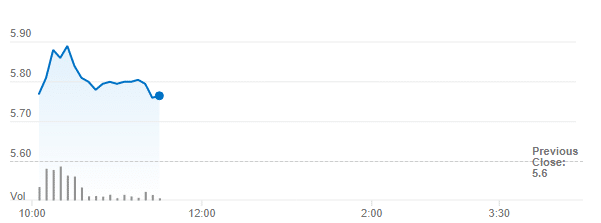

As of the 11.52 am 2 April 2022 the QANTAS share price was up by 2.32%

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Arista Networks tops estimates for Q1

Arista Networks Inc. reported its Q1 financial results after the closing bell in the US on Monday, beating Wall Street estimates. The US computer networking company reported revenue of $877.066 million (up by 31.4% year-over-year) vs. $856.14 million expected. Earnings per share reported at $0.84 per share (up by 35.48% year-over-year) vs. $0...

May 3, 2022Read More >Previous Article

Amazon records its first loss since 2015

Amazon has followed some of the other tech sector players in providing weaker than expected quarterly results. The global giant saw its share price dr...

May 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.