- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX analysis – USD bounces back, JPY, GBP and AUD all under pressure as risk sentiment sours.

- Home

- News & analysis

- Forex

- FX analysis – USD bounces back, JPY, GBP and AUD all under pressure as risk sentiment sours.

News & analysisNews & analysis

News & analysisNews & analysisFX analysis – USD bounces back, JPY, GBP and AUD all under pressure as risk sentiment sours.

12 September 2023 By Lachlan MeakinTuesdays FX session is turning out to be a mirror image on Monday’s session Where the USD was battered against its major peers. Today, seeing almost a full retrace of those moves as USD is once again king.

The Dollar Index (DXY) respected the upward trendline support that has led DXY higher since July (with the exception of a brief break in early September). A less aggressive CNH fix by the PBoC and sour risk sentiment also helping the Dollar. DXY rebounding strongly in Tuesday’s session so far, the 105 level will be key. DXY has found increasing resistance above this level for the last 12 months and with an empty news calendar in the US a push higher through the key 105 level in today’s session would be tough going.

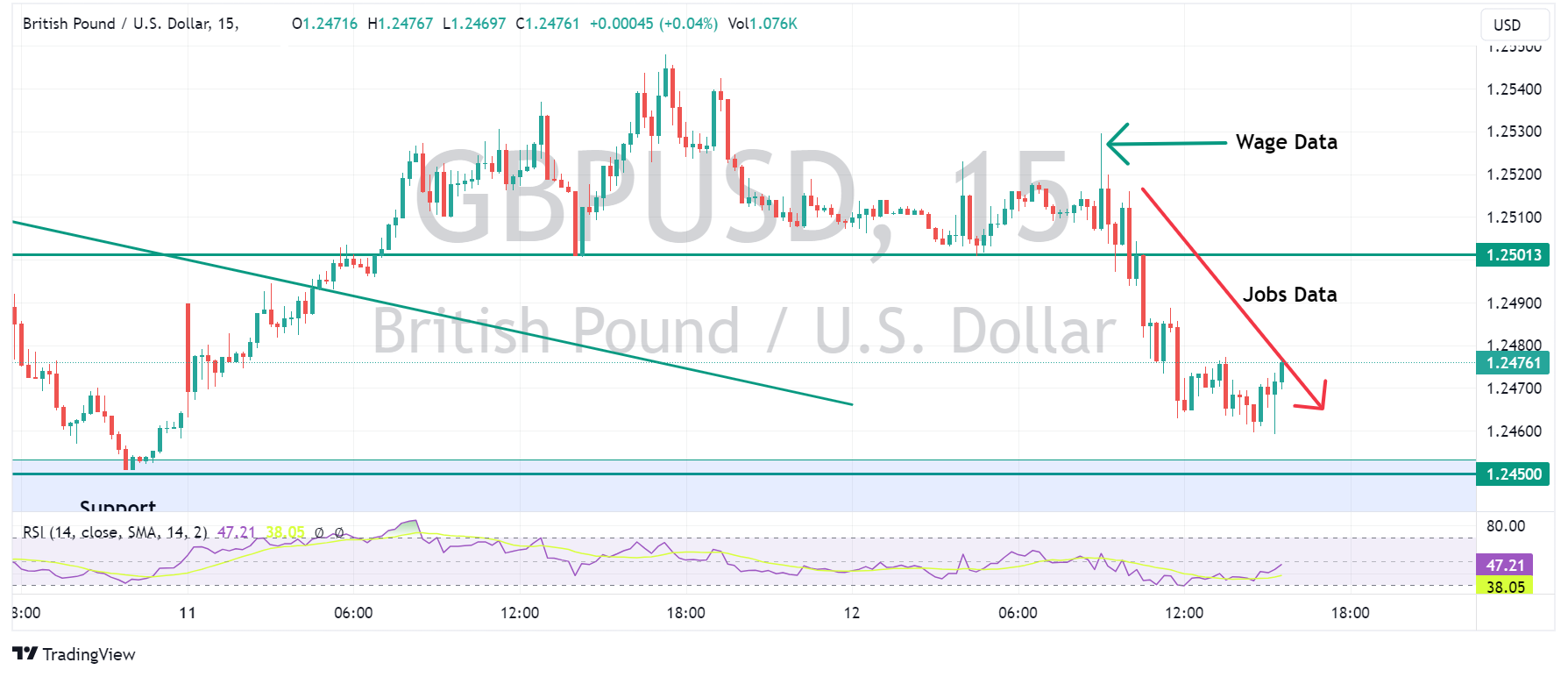

GBPUSD had an initial and very brief spike higher on a hot headline UK average earnings figure, but quickly retraced from a high of 1.2530 , losing the psychological 1.2500 as other jobs data painted a grim picture , with the unemployment rate a 200k+ drop in the employment and downward revisions on previous data weighing on Sterling.

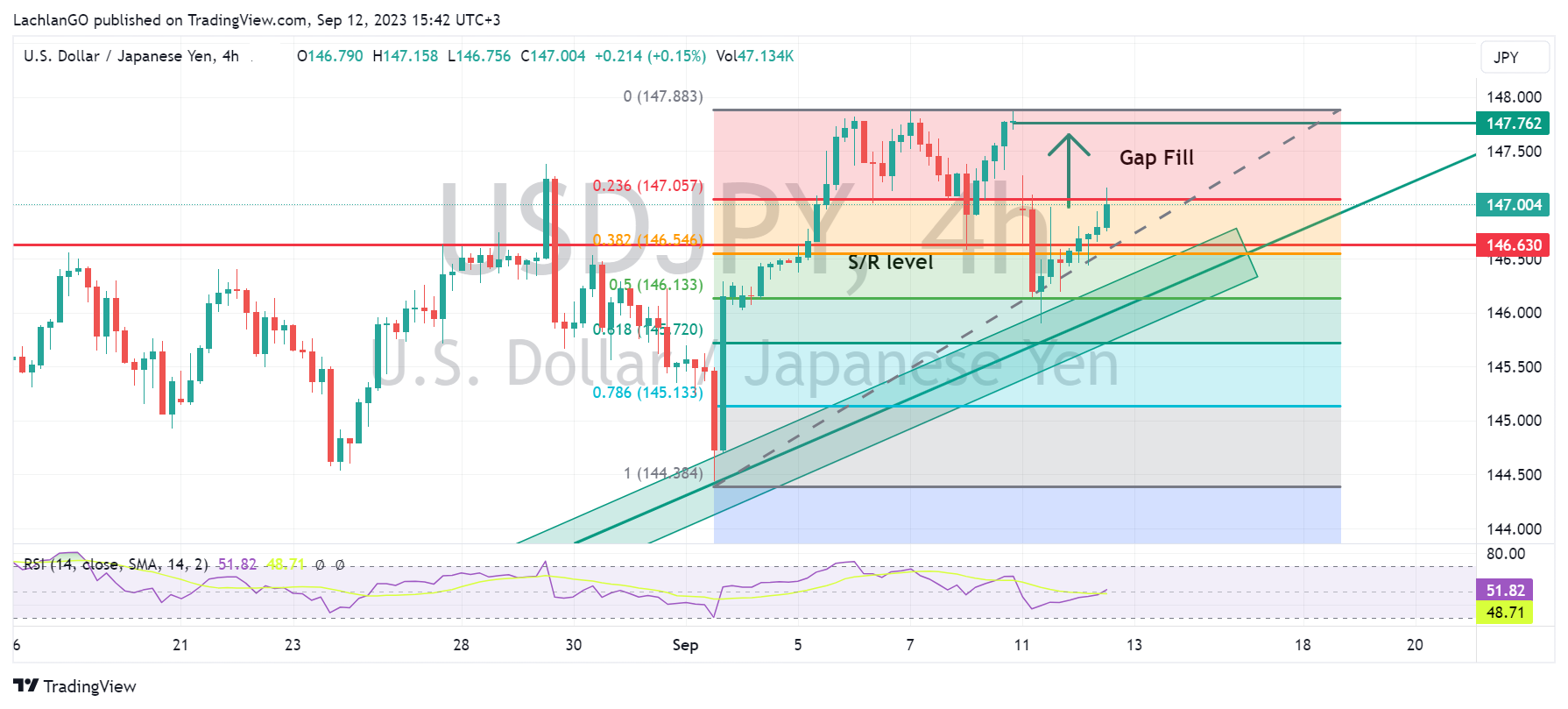

USDJPY continued to march higher, looking to fill the gap after the Monday open gap down on Japanese jawboning over the weekend. USDJPY did breach the psychological 147 level earlier in the session but has found some resistance there and at the 23.6 Fibonacci level (147.06) going into the US session.

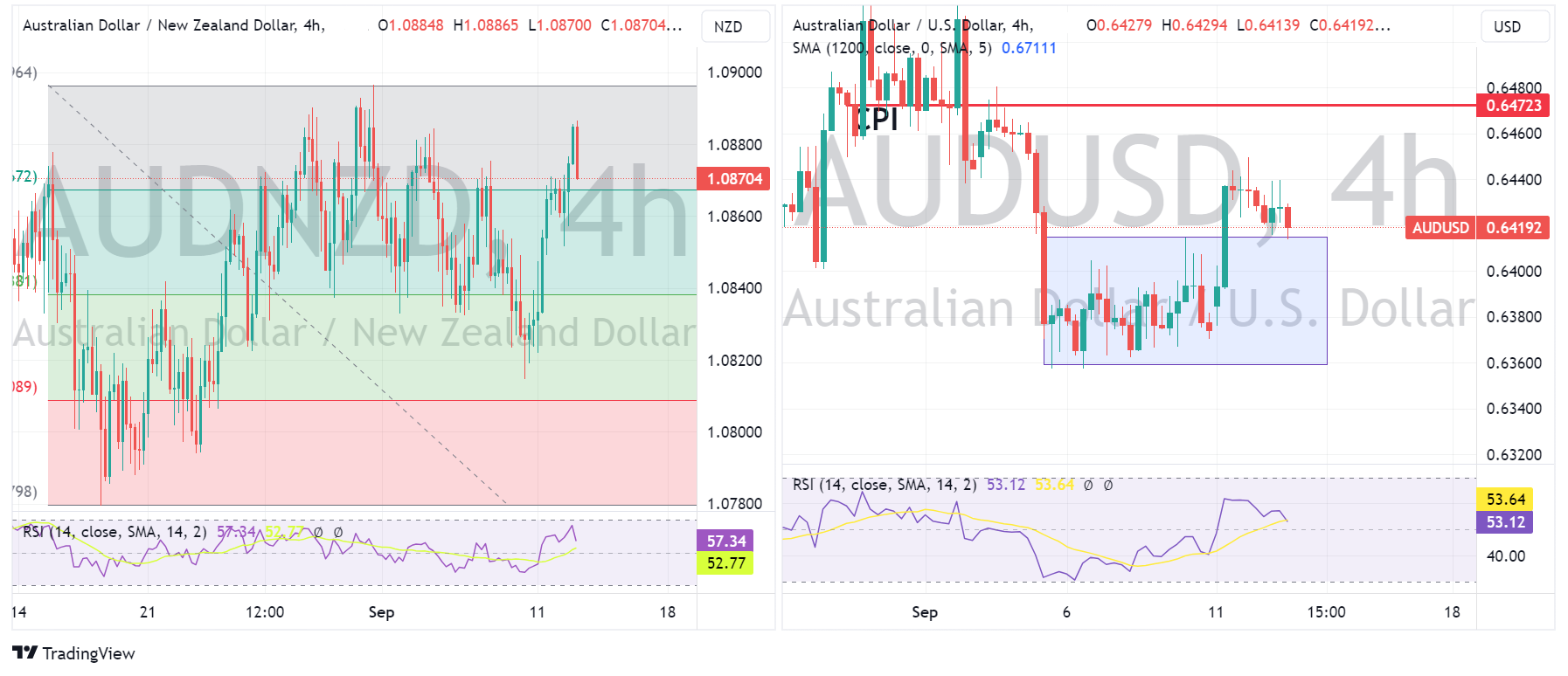

AUDUSD gave back some of the big gains in Mondays session, but a rebound in the price of iron ore and a relatively firm CNH helped the Aussie stem it’s losses against the USD and certainly out performed its Antipodean rival the NZD. AUDUSD holding the key 0.6400 level trading within 0.6417-40 , AUDNZD trading near the top of its recent range, getting to a high of 1.0885 in the Asian session. NZD undermined by downgrades to NZ fiscal projections in a pre-election report.

The US economic calendar is empty of key risk events in Tuesday’s session, all eyes will be on tomorrows pivotal CPI report though.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

USD and yields firmer ahead of US CPI

The USD has remained bid today heading into today’s pivotal US CPI where both the headline M/M and Y/Y figures are expected to show an increase over Julys readings. This is the last major inflation figure before next weeks FOMC meeting where the Fed is widely expected to hold rates (Fed Funds futures pricing in only a 7% chance of a 25bp hike). ...

September 13, 2023Read More >Previous Article

FX Analysis – JPY Bid on Ueda Comments, GBP Reclaims Key Level Ahead of Jobs Figures, AUD breaks range.

Comments from Bank of Japan governor Ueda over the week saw USDJPY gap significantly lower at the Asian session open. The pair now trading well under ...

September 11, 2023Read More >Please share your location to continue.

Check our help guide for more info.