- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX Analysis – Yields and USD rise again, AUD clobbered, JPY intervention?

- Home

- News & analysis

- Forex

- FX Analysis – Yields and USD rise again, AUD clobbered, JPY intervention?

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – Yields and USD rise again, AUD clobbered, JPY intervention?

4 October 2023 By Lachlan MeakinThe first week of the new quarter has so far been an interesting one, rampant US treasury yields breaking out to 16-year highs, a USD that just keeps going up and now it seems the Japanese Ministry of Finance is directly intervening in currency markets.

USD rose to a high of 107.35 on the back of a surge in yields and a hawkish US JOLTS report which showed the US labor markets resilience. Fed member Mester also spoke noting the Fed will likely need to hike rates one more time this year adding to the higher for longer narrative. The USD did dip later in the session on what seemed to be a Japanese FX intervention, DXY still holding the key 107 level though.

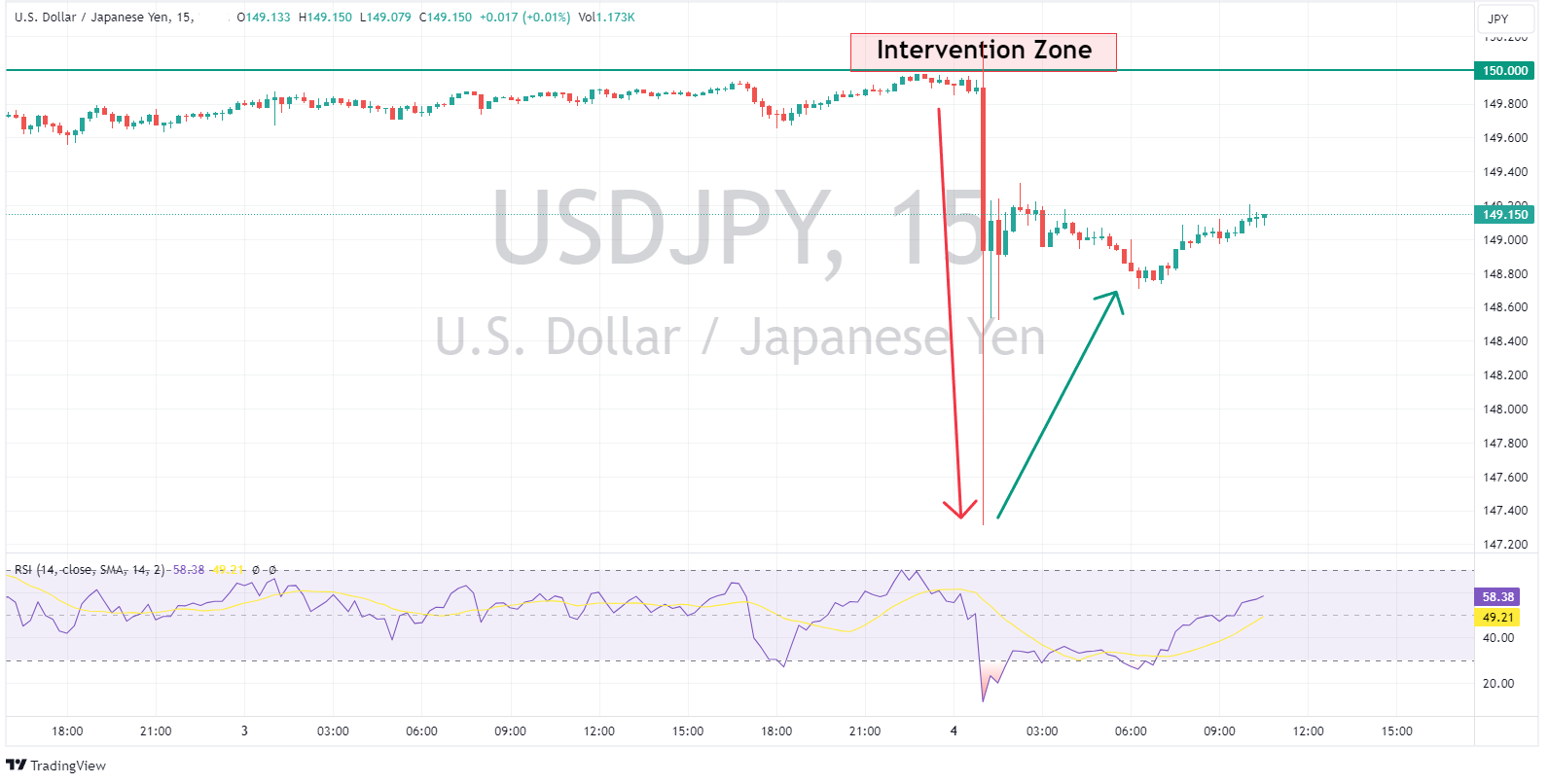

JPY was again weak early in the session with USDJPY hitting a high of 150.16 , above the “line in the sand” at 150. The weakness dramatically reversed on what could only be a BoJ intervention in the FX market seeing USDJPY sharply move lower 3 big figures in a heartbeat, hitting a low of 147.31. There has been no official confirmation this was an intervention but with recent jaw boning from Japanese officials threatening just that, it seems obvious it was. USDJPY recovered after the dust settled to reclaim the 149 level, but from my experience this won’t be the last intervention so USDJPY longs should tread with caution from here.

AUD underperformed with the Aussie struggling against a strong USD, sour risk sentiment and post RBA where the Aussie Central Bank kept rates on hold and gave nothing extra for the hawks in their statement. AUDUSD dipped below 0.63 before finding some support around the Nov ’22 lows and retaking the 0.63 support level for now.

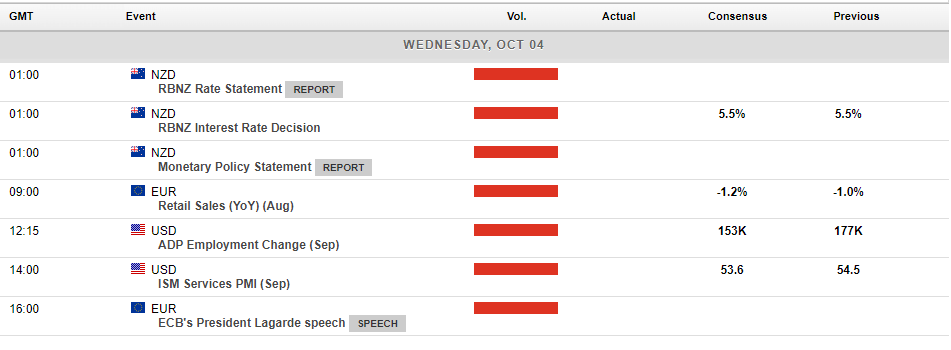

Today’s economic announcements:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

FX Analysis – Yields and Dollar drop ahead of NFP , AUD and NZD outperform, JPY traders watching the 150 level

The USD sell off continued Thursday moving in lockstep with yields again ahead of today’s key non-farm payroll figure. Unemployment claims came inline and had a limited impact as it was yields driving action in the USD. DXY dropped to close at the lows of 106.32 from earlier highs of 106.86. So far this looks like a technical pullback from over...

October 6, 2023Read More >Previous Article

FX Analysis – USD surges, USDJPY tests BoJ resolve at 150, AUD weak ahead of RBA

USD continued to run higher in Monday’s session with US yields surging to highs not seen since 2007. Beats in both US manufacturing and employment d...

October 3, 2023Read More >Please share your location to continue.

Check our help guide for more info.