- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

CFD trading

Trade CFDs on forex, commodities, indices, and more.

Open accountTo open a CFD trading account as a Company, Trust, or SMSF, click here.

Share trading

Invest in shares and ETFs on the Australian share market.

Open accountOpen a Personal or Company/Trust/SMSF share trading account.

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- FX markets analysis – DXY, JPY, AUD, MXN, CNH, EUR

- Home

- News & analysis

- Economic Updates

- FX markets analysis – DXY, JPY, AUD, MXN, CNH, EUR

News & analysisNews & analysis

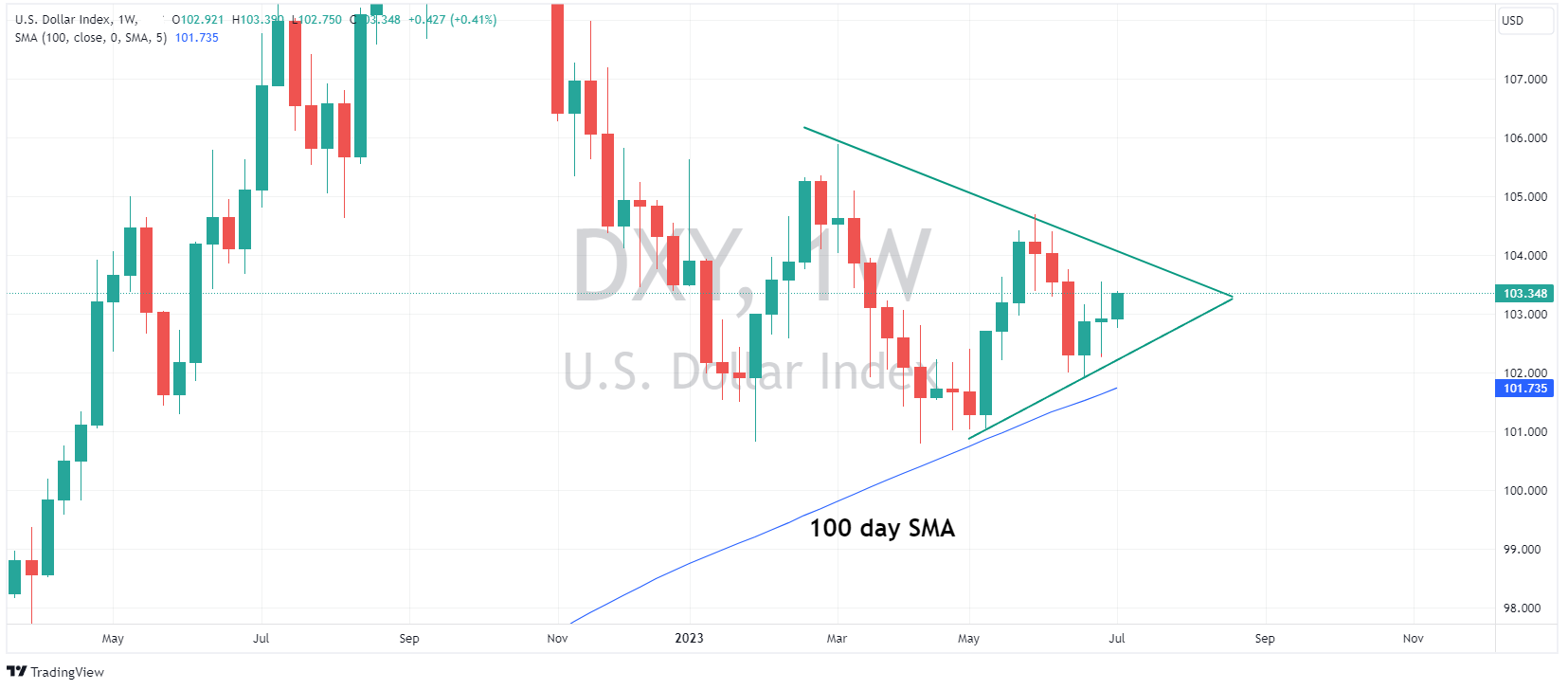

News & analysisNews & analysisUSD rose on Wednesday with participants returning from the long weekend pushing the Dollar Index above the key 103.00 level. FOMC minutes from the June meeting were released, with nothing new in Dot Plot projections but they did confirm that some policymakers were pushing for a 25bp hike rather than the hold we got, which lent support to the USD. A sharp move higher in US Treasury yields also giving the USD a tailwind. DXY continuing to hold above the 100 Day SMA and forming a rising wedge pattern, some big data later this week from the US will likely decide which direction it breaks out from here.

EUR saw some downside on the back of USD strength with EURUSD falling from peaks of 1.0907 to close at session lows of 1.0852. Not much in the way of EU news but there was comments from ECB’s Visco who said he doesn’t understand and doesn’t agree with those who prefer the risk of tightening too much rather than too little which stymied some of the losses in EUR.

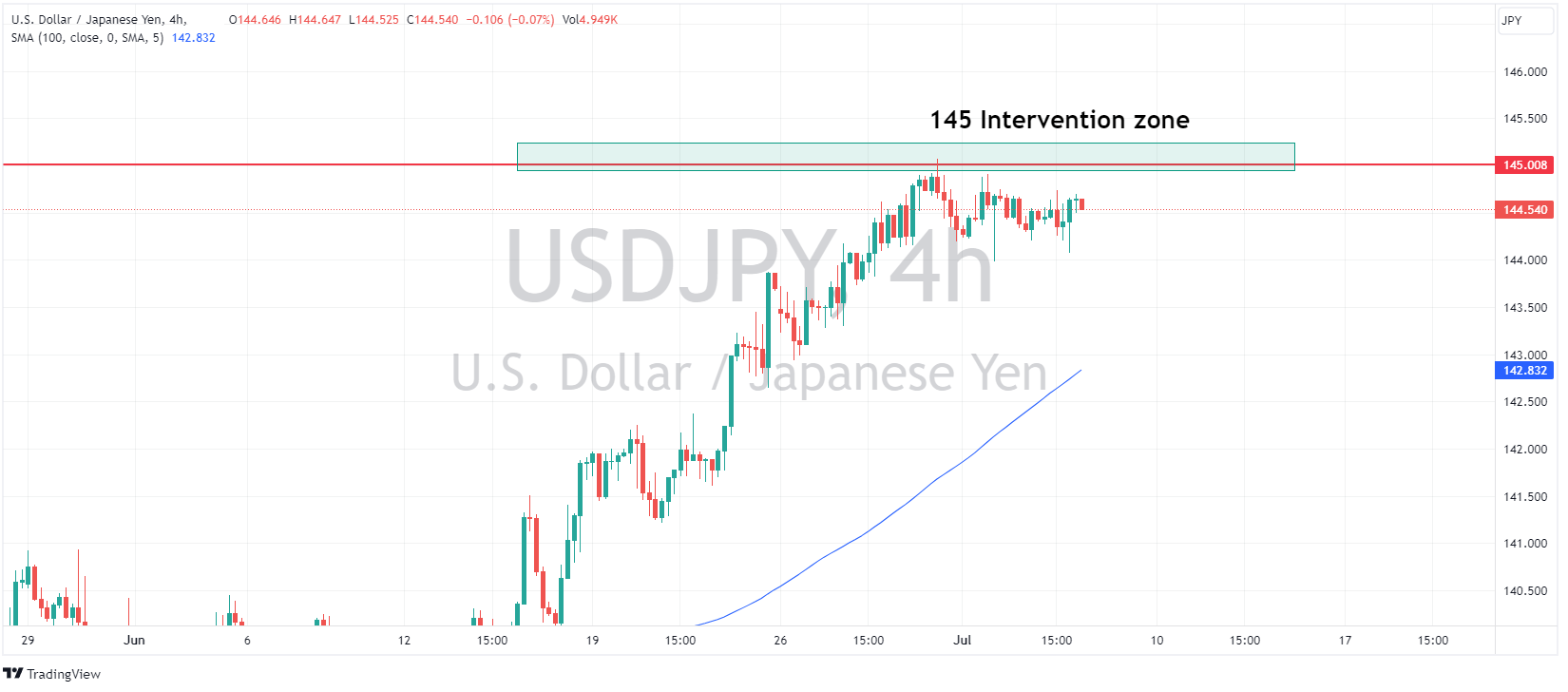

JPY was marginally weaker vs the USD , Asian session strength in the Yen saw USDJPY fall to test 144 to the downside coming in within 9pips of the round level before paring back above 144.50 with a push higher in UST yields driving the reversal, traders seem very aware of previous BoJ intervention around the 145 level which has seen the uptrend come to a halt for now.

The Chinese Yuan saw weakness vs the USD, despite a firmer than expected Yuan fixing, after a miss in the Caixin PMI data and tensions regarding export controls rare metals. USDCNH rallying strongly to close in on the June and 2023 highs of 7.2855

AUD was the G10 underperformer with Aussie traders still digesting the latest RBA meeting where rates were left unchanged and ahead of today’s May trade balance data. The weaker CNH also weighing on the Aussie, keeping AUDUSD beneath the 200 Day SMA which acted as resistance.

In EM FX the MXN was the outperformer, with USDMXN falling beneath 17 for the first time in over seven years. USDMXN continuing to trend downwards with as an attractive carry trade opportunity and a hawkish tone from the Mexican Central bank.

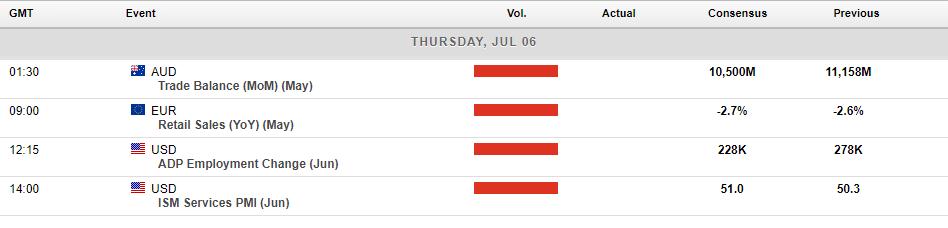

Today’s Economic Calendar below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Charts to Watch in the Week Ahead – BoC rate decision, US CPI, RBNZ, UK wage and jobs data

Central banks are back in action in the coming week with the Bank of Canada and RBNZ scheduled to release their latest monetary policy and official rate decisions, also some key data from the US and the UK which will go a long way to cement market expectations of the next move from their Central Banks. Charts to watch this week: GBPUSD : UK...

July 10, 2023Read More >Previous Article

Understanding market data: Purchasing Managers Index (PMI)

The Purchasing Managers' Index (PMI) is an economic indicator used to measure the health and activity level of a specific sector of an economy, namely...

July 5, 2023Read More >Please share your location to continue.

Check our help guide for more info.