- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX wrap – GBP volatile on BoE surprise, JPY and CHF under pressure, USD follows yields up

- Home

- News & analysis

- Forex

- FX wrap – GBP volatile on BoE surprise, JPY and CHF under pressure, USD follows yields up

News & analysisNews & analysis

News & analysisNews & analysisFX wrap – GBP volatile on BoE surprise, JPY and CHF under pressure, USD follows yields up

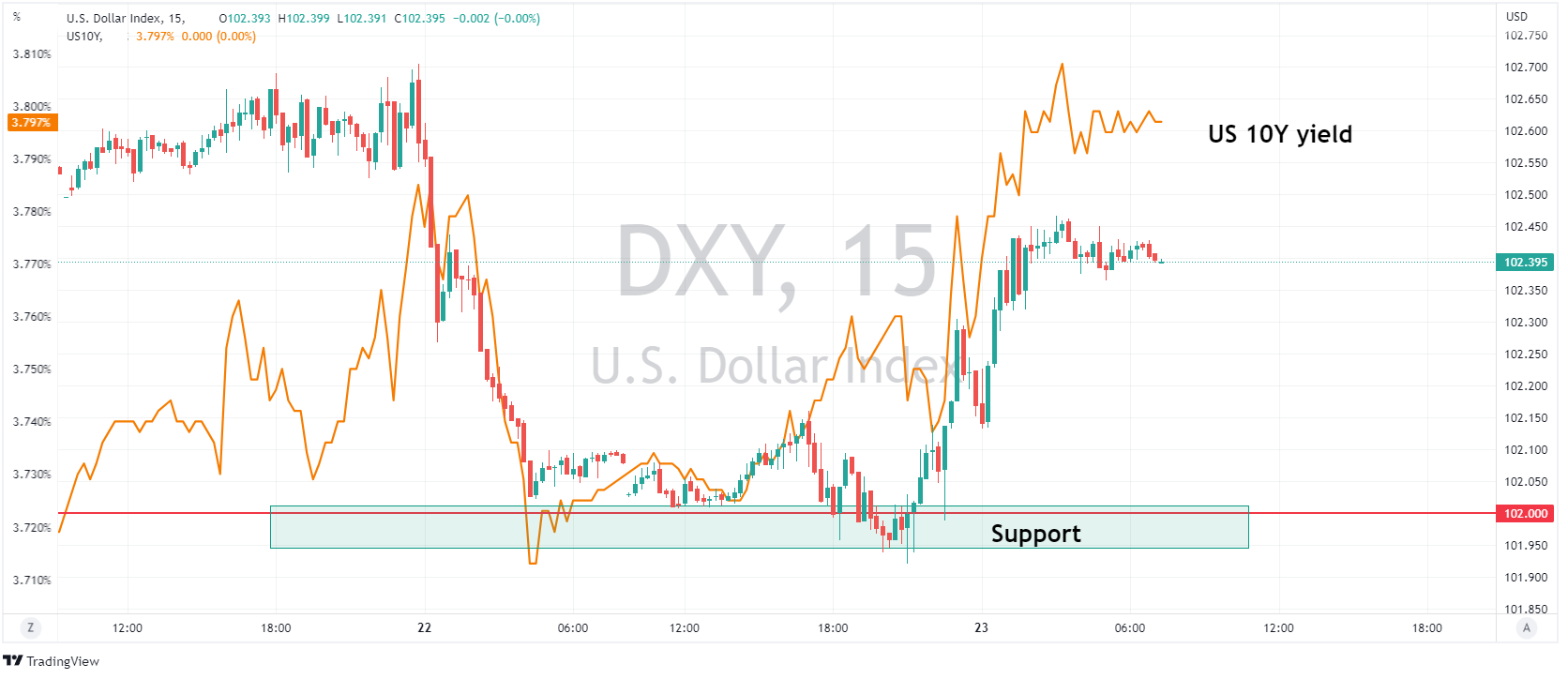

23 June 2023 By Lachlan MeakinUSD was firmer on Thursday, largely due to a rally in treasury yields with the DXY tracking the 10 year yield higher to a peak of 102.470 after bouncing off the psychological 102 support level. US data was mixed with Unemployment claims and current account figures coming in worse than expected, but this was offset by a beat in Existing home sales. There was a selection of Fed speakers, with the Chair Powell headlining. Little new was revealed with Chair Powell re-iterating the FOMC broadly feels it will be appropriate to raise rates again this year which surprised no-one.

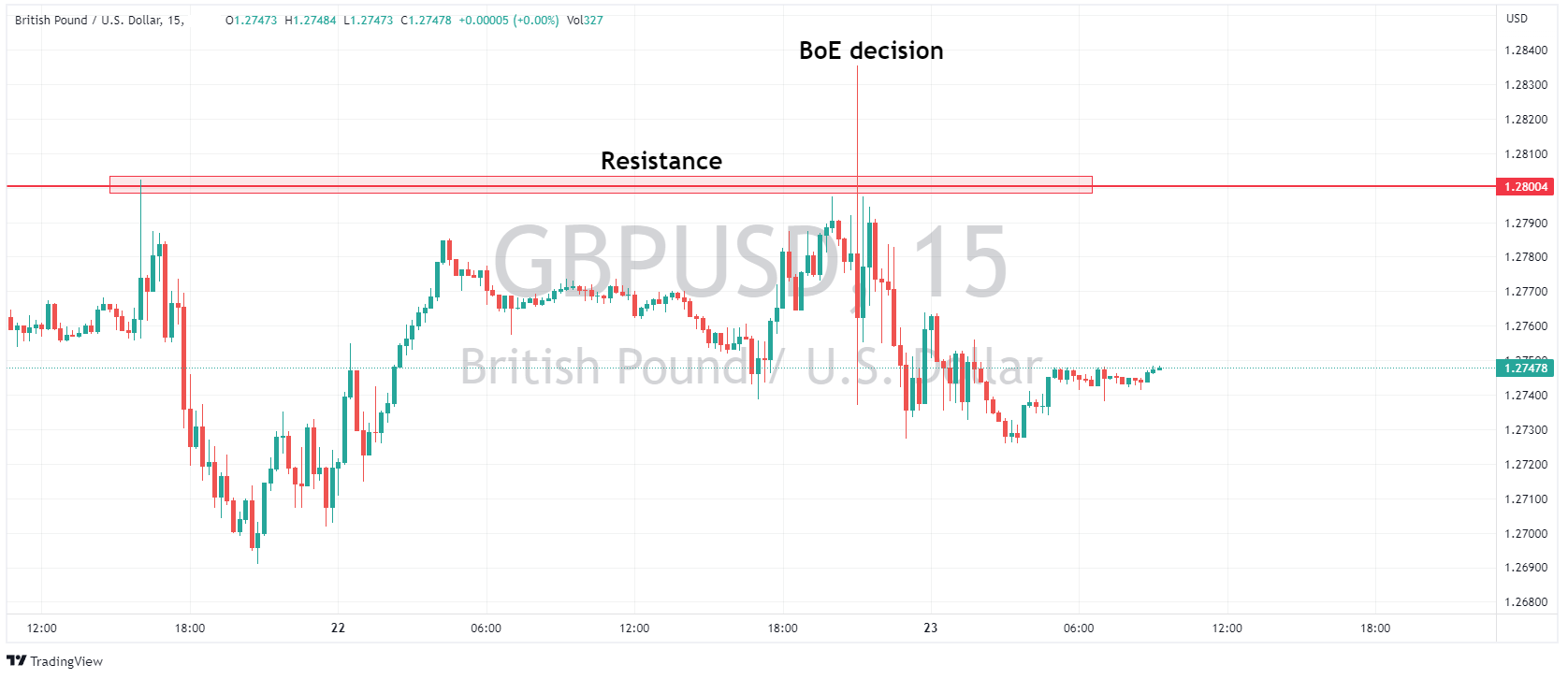

GBP was volatile after the BoE somewhat surprised markets with a larger than expected 50bp hike, going into the meeting a 25bp was the favoured outcome by economists, but a 50bp was partially priced in so not a totally unexpected move from the BoE. The bank also maintained guidance further tightening would be required if there was more evidence of persistent inflation. Post decision GBPUSD hit a high of 1.2838 in a knee jerk reaction before reversing the move and eventually hitting lows of 1.2728 in similar price action we saw after Wednesdays hotter than expected CPI figure. GBP price action is indicating the market feels further hawkish re-pricing of BoE action is limited, with fears that the current projected path will lead to recession in the UK weighing on the Pound and Cable will struggle to breach the major resistance at 1.28.

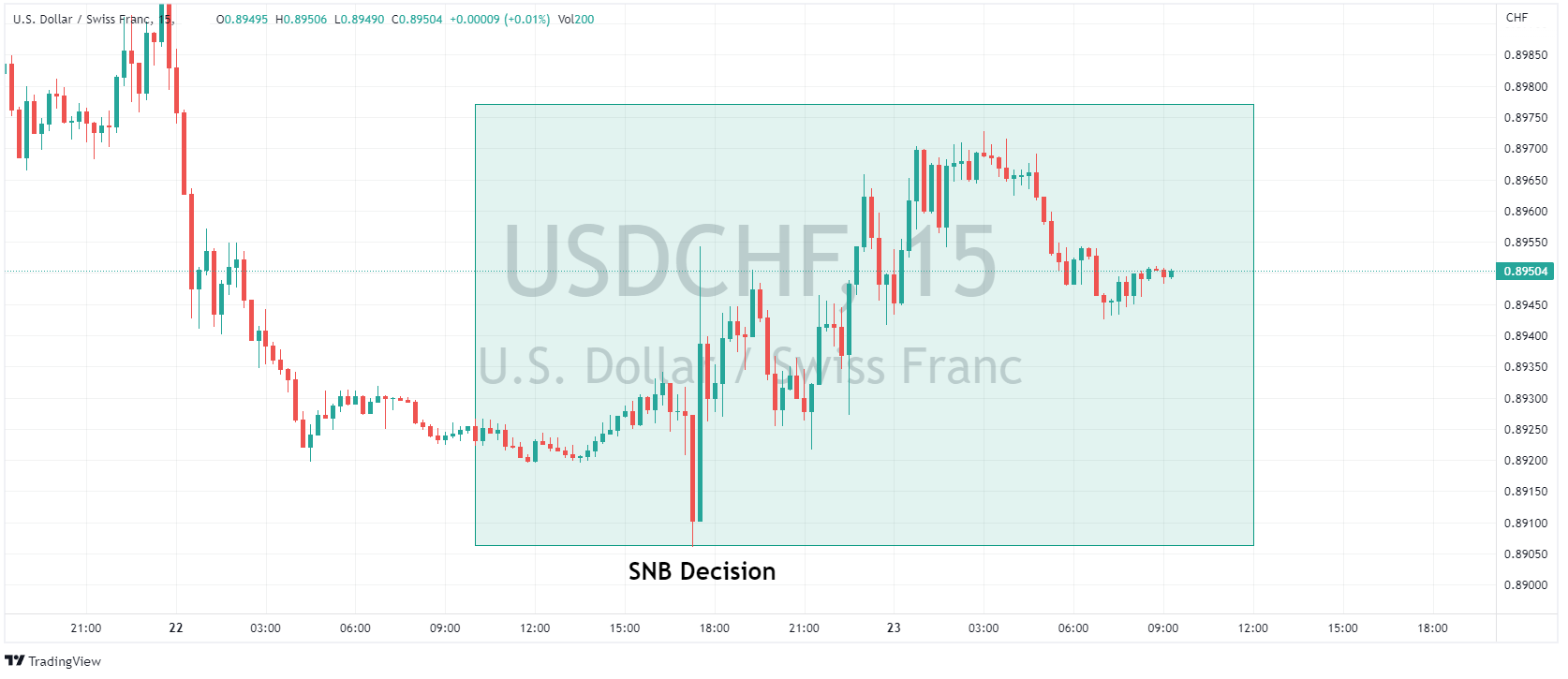

CHF was lower vs the USD after seeing weakness in the aftermath of the SNB rate decision where the SNB hiked by 25bps disappointing some market participants who were looking for a 50bp move. The SNB did note however that additional rate hikes will be necessary. After an initial spike lower to test the 0.8900 support zone, USDCH reversed course, hitting a high of 0.8973 before finding some selling.

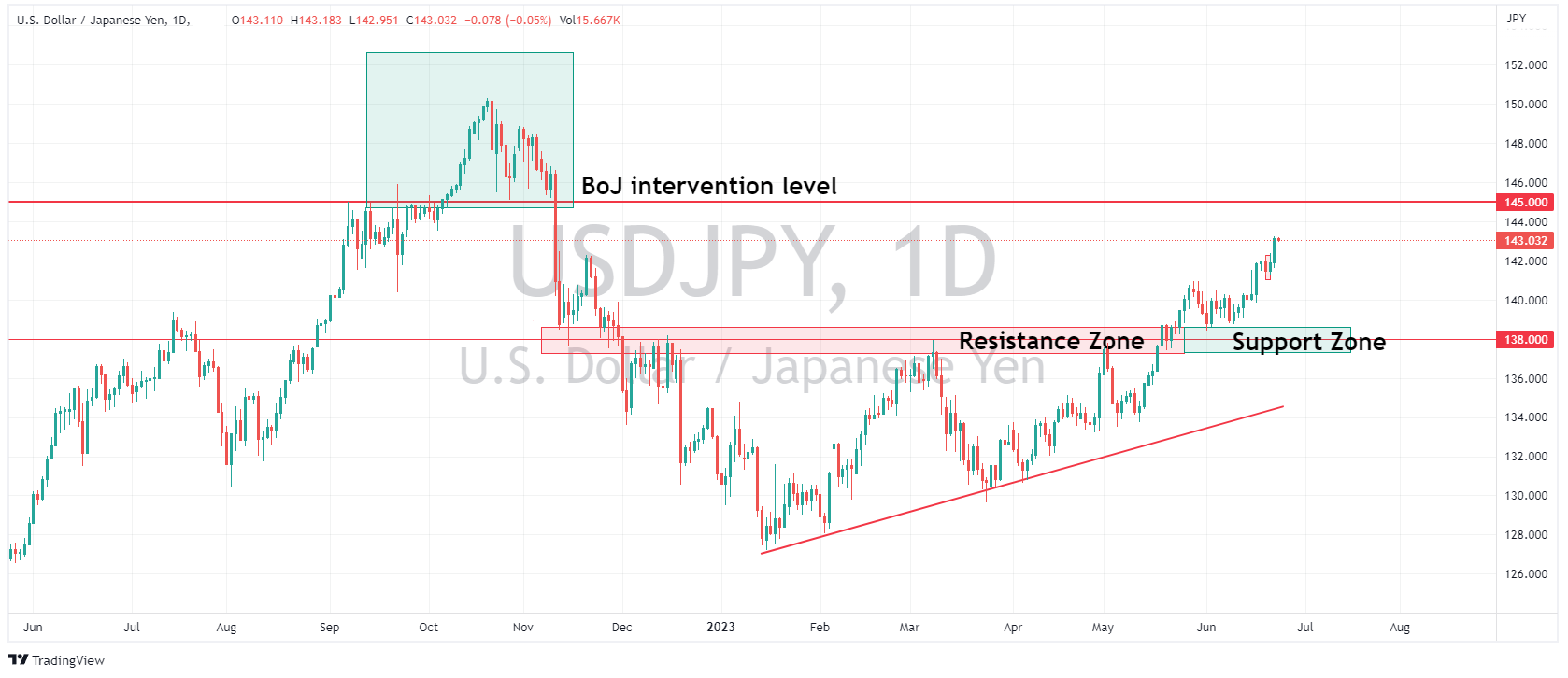

JPY was the G10 underperformer with USDJPY printing a fresh 2023 high of 143.22 after breaching the key 142.50 level , with a CPI report coming up today, another close above this level could see a technical continuance to test the 145 level. Recent Fed speak has also raised the issue that US treasury yields are likely to continue to rally, increasing the rate differential between US10Y and JGBs which will also be a major tailwind to get the pair to 145, which is where the BoJ’s November USDJPY intervention was launched.

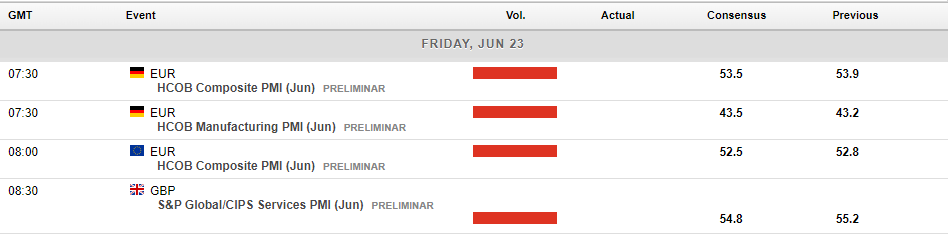

Todays calendar of major risk events below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

The VIX Explained: What Every Trader Needs to Know

Introduction The VIX Index, or Volatility Index, often referred to as the "fear gauge," measures expected future volatility in the U.S. stock market. Although it's worth noting that there are VIX variations for gold, oil, and global indices, when people discuss the VIX, they usually refer to the instrument based on the implied (forward looking ...

June 23, 2023Read More >Previous Article

Money in Motion: The Factors Influencing Currency Appreciation and Depreciation

Currency appreciation refers to the increase in value of one currency relative to another currency or basket of currencies. Depreciation refers to the...

June 21, 2023Read More >Please share your location to continue.

Check our help guide for more info.