$0 swaps on crypto CFDs

Trade all crypto CFDs with $0 overnight costs.

24/7 access, 39 crypto CFDs.

Available for a limited time only.

For beginners

Just getting

started?

Explore the basics and build your confidence.

For intermediate traders

Take your

strategy further

Access advanced tools for deeper insights than ever before.

Professionals

For professional

traders

Discover our dedicated offering for professionals and sophisticated investors.

Trusted by traders worldwide

Since 2006, GO Markets has helped hundreds of thousands of traders to pursue their trading goals with confidence and precision, supported by robust regulation, client-first service, and award-winning education.

Explore more from GO Markets

Platforms & tools

Trading accounts with seamless technology, award-winning client support, and easy access to flexible funding options.

Accounts & pricing

Compare account types, view spreads, and choose the option that fits your goals.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

REMX approaches key resistance after a sharp rebound

- Instrument: REMX (VanEck Rare Earth and Strategic Metals ETF)

- Time horizon: Short-to-medium term

- Bias: Neutral-to-bullish while above support

- Key levels: Resistance $75, support $68, next resistance $81

Rare earth and strategic metals equities have been among the stronger-performing thematic areas in 2025, though recent price action suggests the rally has paused as investors reassess momentum. REMX has rebounded sharply from its April lows and is now consolidating below a technically significant resistance zone near $75, making it a key level to monitor.

What is REMX?

REMX is an exchange-traded fund that provides diversified exposure to global companies involved in mining, refining, and recycling rare earth and strategic metals. For traders and investors who want sector exposure without relying on a single issuer, the ETF structure can help spread company-specific risk. Performance will still be highly sensitive to commodity cycles and policy/geopolitics.

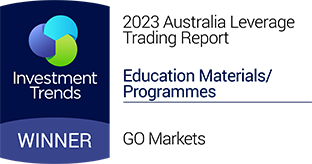

Portfolio snapshot

The ETF’s larger positions typically include a mix of rare earth producers and lithium-related names. Examples of top holdings (approximate weights, based on the fund’s most recent publicly available holdings data)

Why rare earths and strategic metals matter

Rare earth elements (a group of 17 metals) are not necessarily scarce in the earth’s crust, but economically viable deposits—and especially processing capacity—are concentrated. This creates a supply-chain dynamic where policy decisions, trade restrictions, and downstream demand can have outsized impacts on pricing and sentiment.

Key demand linkages include:

- EVs and wind power (permanent magnets and motors)

- Electronics (speakers, screens, storage)

- Defence/aerospace (guidance, radar, specialised alloys)

- Industrial catalysts (refining and emissions control)

Technical outlook

After marking multi-year lows around $33 in early April, REMX rallied strongly and returned to levels last seen in mid-2023. The $75 area stands out as a prior multi-touch support zone (2021–2023), which increases the probability it acts as resistance on the first approach.

REMX weekly chart

Price has repeatedly tested $75 over the past month without a confirmed breakout. The pattern of higher lows against flat resistance resembles an ascending triangle, often associated with building pressure; however, confirmation requires a decisive break.

REMX daily chart

Scenarios to watch

- Bullish continuation: A daily close above $75 (ideally with expanding participation) would shift focus to $81 as the next resistance zone.

- Range continuation / pullback: Failure to clear $75 again keeps the risk of a retracement toward $68 support.

- Bearish breakdown: A sustained move below $68 would weaken the structure and raise the probability of a deeper mean reversion (next support levels should be mapped from prior swing lows).

.jpg)

US indices pulled back from record highs after the Fed signalled no rate cut in January. The Nasdaq was hit hardest with AI sector anxiety resurfacing.

Combine that with this week's shutdown-delayed jobs data release, and questions are mounting on whether markets can muster a Santa Claus rally this year.

Delayed Jobs Data Could Define Santa Rally

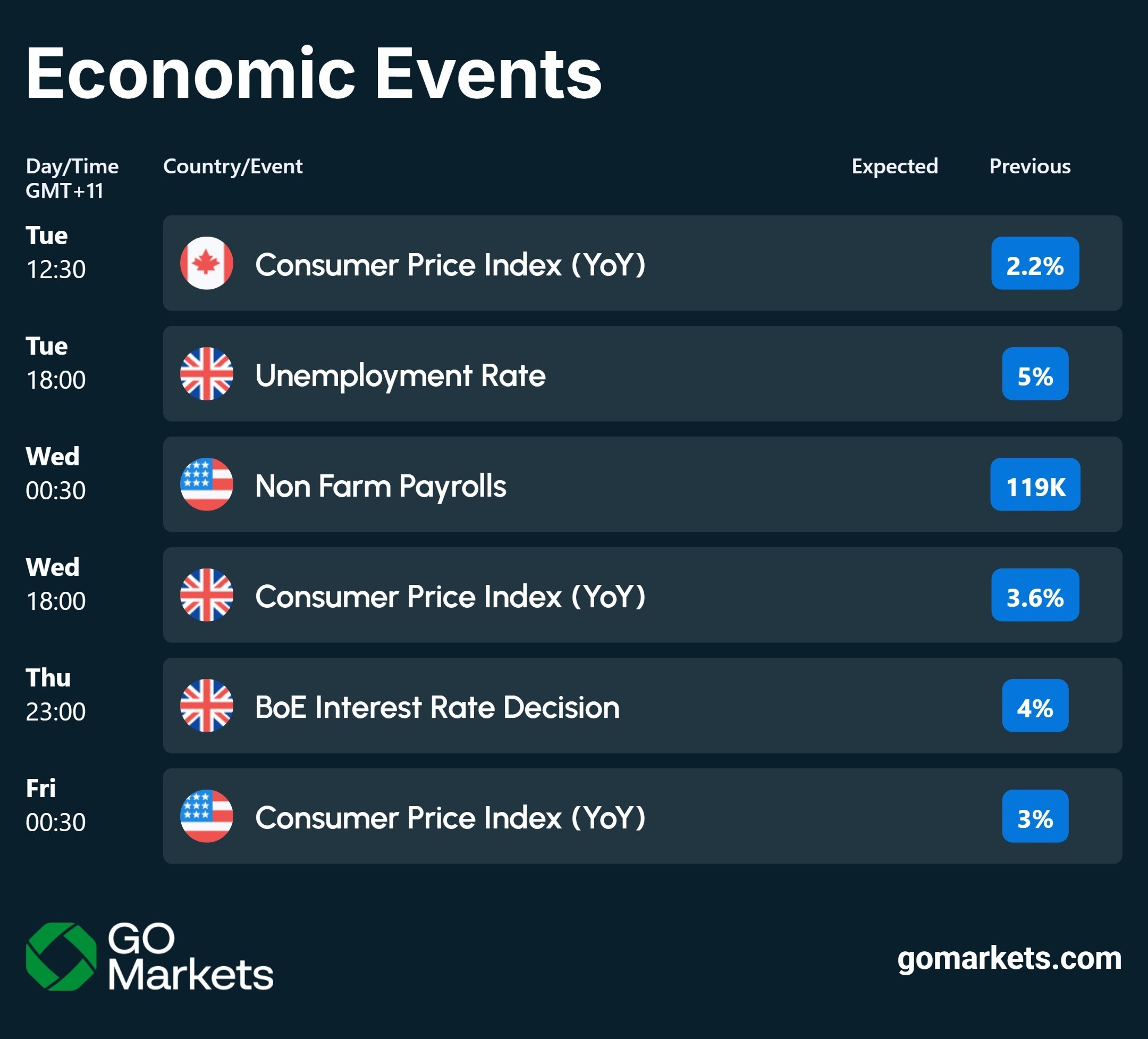

- This week delivers critical economic data that was postponed during the government shutdown:

- Tuesday: Non Farm Payrolls

- Thursday: Consumer Price Index (CPI)

- These two releases could determine whether markets can rally or face further pressure into Christmas.

- Volatility is expected around both announcements as traders position for potential surprises.

ECB and Bank of England Enter Rate Decision Spotlight

- The European Central Bank and Bank of England both announce rate decisions this week.

- EUR and GBP traders should watch closely for any policy divergence that could create currency volatility.

- Cross-border flows may shift as investors weigh different central bank trajectories.

Flash PMI Data Offers Real-Time Economic Pulse Tomorrow

- Tomorrow delivers a global economic snapshot through flash PMI releases from Japan, Australia, Europe, the UK, and the US.

- Markets could react fast to these forward-looking indicators.

- Any regional divergence could signal shifting economic momentum across major markets.

Market Insights

Watch Mike Smith's analysis of the week ahead in markets.

Key Economic Events

Stay up to date with the key economic events for the week.

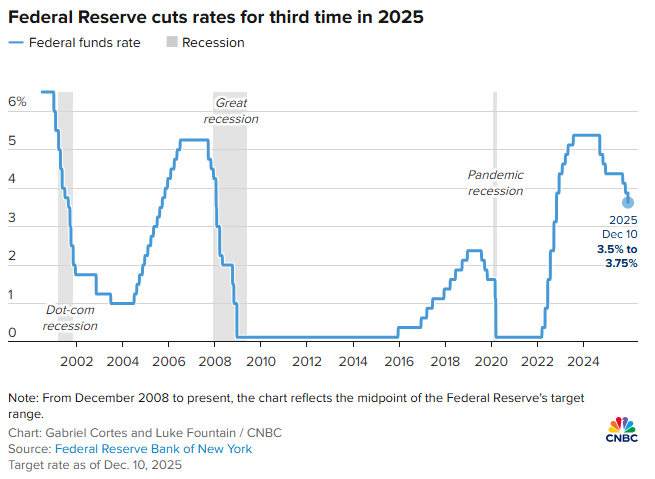

The Federal Reserve delivered its third consecutive rate cut this morning, lowering rates 25 basis points to 3.5%-3.75% after a 9-3 vote in favour.

The three dissents were the most seen since September 2019. Governor Stephen Miran pushed for a steeper 50bp cut while regional presidents Jeff Schmid and Austan Goolsbee wanted to hold steady.

Four additional non-voting participants also preferred no cut at all, exposing deep disalignment on the best policy path going forward.

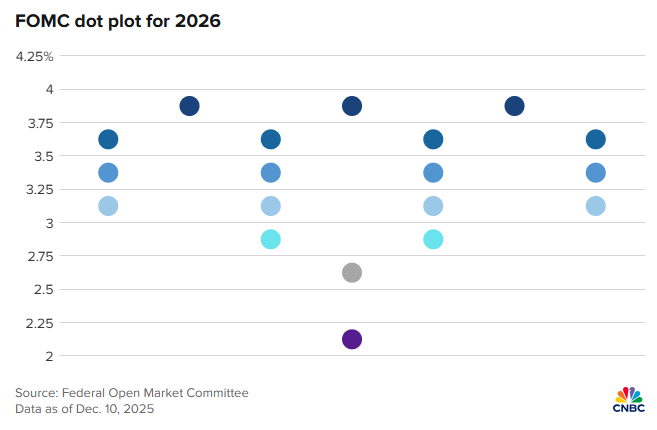

The updated Federal Reserve dot plot maintained projections for just one cut in 2026 and another in 2027, unchanged from September despite three cuts delivered since then.

Seven officials now see no cuts needed next year, while three believe rates are already too low, suggesting the divide between members is set to continue growing in 2026.

In his post-meeting press conference, Fed chair Jerome Powell explicitly stated, "We are well positioned to wait and see how the economy evolves." — phrasing last used when the Fed paused cuts for nine months.

However, with Powell's tenure ending in January and Trump publicly demanding deeper cuts, the Fed continues to face mounting pressure, further clouding 2026 projections.

Markets are currently pricing Kevin Hassett as the next chair, thanks to his apparent accommodation to Trump’s preferences.

Oracle Stock Plummets as Revenue Falls Short of Estimates

Oracle Corporation suffered a 10%+ after-hours selloff today, following fiscal second-quarter results that exposed mounting risks beneath its ambitious AI infrastructure buildout.

Revenue of $16.06 billion fell short of the $16.21 billion Wall Street consensus, triggering a sharp reassessment of one of the most leveraged bets in the AI sector.

The company's total debt now exceeds $105 billion, and the cost of insuring Oracle's debt against default reached its highest level since March 2009, rising to about 1.28 percentage points per year.

Further investor anxiety lies in Oracle's dependence on its contract with OpenAI, which is estimated to account for about 58% of Oracle's future order backlog.

The contract requires OpenAI to pay approximately $60 billion annually to Oracle starting in 2027. However, OpenAI currently only generates around $20 billion in annualised revenue, exposing Oracle to massive counterparty risk if OpenAI doesn’t meet its revenue projections.

Bitcoin Price Narratives Get Murkier

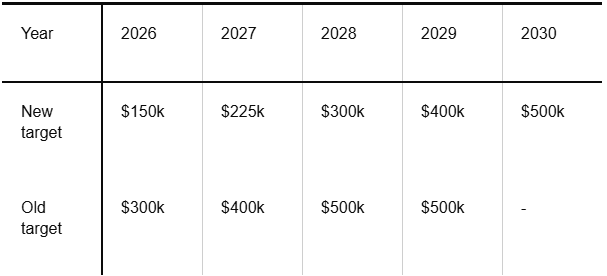

Standard Chartered slashed its 2026 Bitcoin price target from $300,000 to $150,000 yesterday.

Attributed to the apparent end of aggressive corporate Bitcoin accumulation and slower-than-expected institutional adoption through ETFs, it is one of the most dramatic forecast reductions this year.

The bank's updated forecasts project $100,000 by end-2025, $150,000 for end-2026, $225,000 for end-2027, $300,000 for end-2028, and $400,000 for end-2029.

Despite the revision, Standard Chartered explicitly rejects the notion that we have entered a new crypto winter, characterising the current phase as "a cold breeze" rather than structural weakness.

Broader market predictions for 2026 suggest a bearish scenario at $95,241, an average estimate of $111,187, and a bullish case of $142,049.

InvestingHaven forecasts Bitcoin trading between a minimum of $99,910 and a maximum of $200,000 in 2026.

And some bullish analysts like Cardano founder Charles Hoskinson have suggested Bitcoin could reach $250,000 in 2026 if tech giants increase their crypto exposure, indicating considerable divergence in expectations.