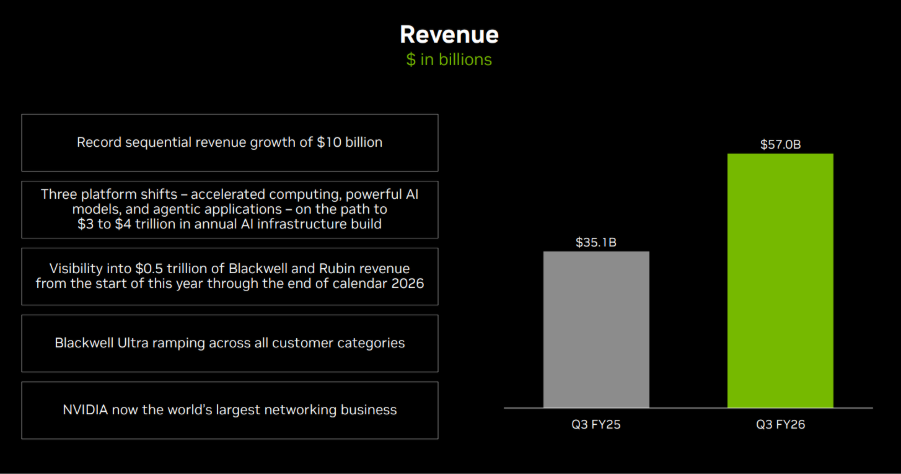

US earnings season is where the market gets its cleanest burst of new information. For Australians, it usually lands while the country is asleep. This is not just “US company news”. It is the scoreboard for the Nasdaq, the S&P 500, and risk appetite more broadly, with spillover into SPI futures, the AUD, and sector mood at the ASX open.

What this guide covers

- The four-wave rhythm (why volatility often clusters around common predictable months)

- The order of play (banks → tech → retailers) and what each group tends to reveal

- Before market open (BMO) vs after market close (AMC)

- The few lines markets care about (surprise vs expectations, and the forward reset)

- How earnings information can flow through to Australia via futures, FX, and sector sentiment

US earnings season basics

Earnings season is the 4 to 6-week window after each quarter when most US-listed companies report a new set of numbers and a new story.

Calendar rhythm and clustering

Earnings does not arrive as a smooth drip. It typically arrives in four recurring waves. Most US reporting clusters around January, April, July, and October. Each wave covers the prior quarter, which is why markets spend the lead-up period building expectations, then reprice quickly as numbers and guidance hit.

The sequence is familiar: banks open, tech dominates the middle, retailers close. That order matters because each group updates a different part of the macro story. If you only track one set of reports, make it the Magnificent 7 — here’s the Mag 7 earnings calendar for 2026 (Aussie-friendly timing)

.png)

Time zones: the two windows

For Australians, the key is when the first move hits.

- AMC (after market close): often Sydney and Melbourne morning, sometimes near the ASX open

- BMO (before market open): often late night, with the initial reaction while Australia sleeps

Daylight saving shifts timings, but the pattern is usually consistent: two windows, often with different liquidity conditions.

How the market digests an earnings event

Earnings is rarely a single reaction. It is a sequence.

- Headline release (EPS and revenue versus consensus)

- Immediate price discovery (often in after-hours or pre-market liquidity)

- Call and Q&A (guidance, margins, and demand tone get tested)

- Next US cash session (follow-through, reversals, broader positioning)

- Australia opens into the aftershock (futures, FX, and sector mood already set)

Translation: volatility often clusters around reporting windows because the calendar can concentrate new information and repricing.

1. Expectations: the scoreboard the market uses

Markets do not price “good” or “bad” in isolation. They price the gap versus expectations, then adjust the forward story. That is why the same quarter can look strong on paper and still disappoint if it lands below what the market had already baked in.

Most headlines boil down to three checks. First, actual results versus consensus. Second, actual results versus what the company previously guided. Third, quality and durability. That tends to show up in margins, the mix across segments, and whether cash flow backs up the earnings number.

2. Guidance: the forward reset

Guidance is where the narrative can change without the quarter changing. A company can deliver the past cleanly, then move the goalposts for what comes next. That forward reset is often what drives the bigger repricing.

In practice, guidance usually lands in a few buckets. Revenue or EPS outlook sets the top-line and earnings path. Margin outlook tells you how confident management is about costs and pricing. Capex language signals how heavy the investment cycle is likely to be. Capital return talk, including buybacks, is a read on balance sheet posture and priorities.

Translation: markets trade forward narratives. Guidance is the mechanism.

3. The call: where tone can add context

Prepared remarks are polished. The call is where the market stress-tests the story. The Q&A is where the edges show up, because that is where analysts push on the parts that matter and management has to answer in real time.

Listen for the tells. Demand language can shift from broad to patchy. Pricing can move from power to pressure. Margin confidence can sound steady or start to carry caveats. And the “we are not breaking that out” moments matter too. What management avoids can be as informative as what it highlights.

4. Holding through the print

Some traders choose to reduce exposure if they’re holding through results, because gaps can occur and stops may not execute at expected levels. A practical risk lens is to consider an adverse gap scenario and assess whether the position size sits within your risk tolerance. If the position only “works” at a size that would be hard to tolerate in a gap, that is useful information too.

5. Trading the headline versus the aftermath

It can help to be clear on what is being traded:

- Trading the print can be high variance

- Trading the trend after can be cleaner

If exposed overnight from Australia, having a plan before the market prints can reduce reactive decisions. “I will figure it out at the open” often becomes another way of saying “I will react”.

Bottom line: this is the week where boring risk management beats clever narratives.

Mag 7: See what the market’s priced in ahead of earnings and what could trigger a repricing

Glossary (quick definitions)

- EPS: earnings per share

- Consensus: the market’s compiled estimate set

- Guidance: management’s forward-looking outlook ranges/comments

- Margins: profitability as a percentage of revenue

- Capex: capital expenditure (investment spend)

- BMO/AMC: before market open / after market close (US reporting labels)

- After-hours / pre-market: trading sessions outside regular US cash hours

- Correlation: how tightly assets move together (often rises in macro or de-risking periods)